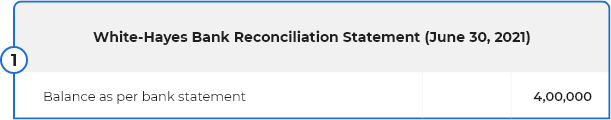

Bank reconciliation statement format

The bank reconciliation statement format includes all the entries of the books maintained in the software, which can be reconciled with your bank statement manually or automatically. With the help of the bank reconciliation statement format, unreconciled entries can be identified, eliminating discrepancies between the books and the bank statement.

Typically, the BRS format includes the bank balance as per the statement, the book balance, and adjustments necessary to reconcile the two balances. A proper bank reconciliation statement format is instrumental in detecting discrepancies caused by delayed deposited cheques or unrecorded entries such as interest accruals, SMS transfers, and other charges. By meticulously preparing a bank reconciliation statement (BRS), these unreconciled entries can be pinpointed and resolved, ensuring accuracy and integrity in financial management across various industries.

Experience auto BRS

How to prepare a Bank Reconciliation Statement (BRS)?

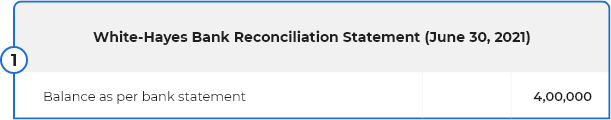

Step 1: Fetch the balance from the bank's e-statement.

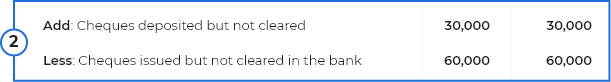

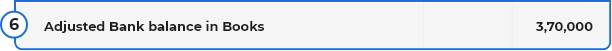

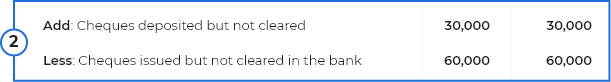

Step 2: Identify the checks that were issued and deposited but have not cleared. Add them separately. These will have an entry in the books, but the status of clearance has not been updated. Therefore, you have to derive the adjusted balance.

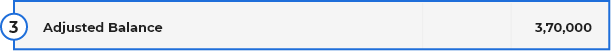

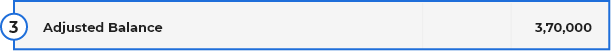

Step 3: Derive the adjusted balance by adding the total amount of cheques issued to the bank balance and subtracting the total amount of cheques deposited from the bank balance.

Step 4: Fetch the bank balance from the book of accounts.

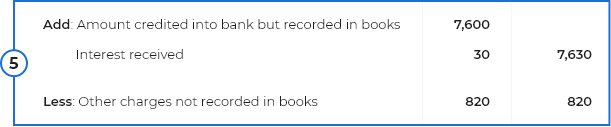

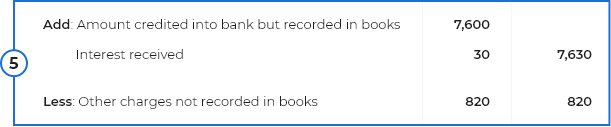

Step 5: Add the amount of entries (debit and credit separately) that were not present in the book of accounts.

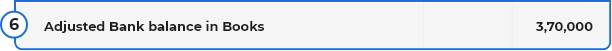

Step 6: Derive the adjusted balance. If both adjusted balances match, you're all set! Your bank reconciliation statement is ready. This tedious six-step process can be simplified with built-in BRS generation in your accounting software; it takes care of preparing your bank reconciliation format automatically.

What is BRS?

A BRS, commonly known as bank reconciliation statement, is a critical financial document that compares a company's own accounting records with those of its bank.

Finding a mismatch in the book of accounts, despite meticulously recording transactions, can pose significant challenges. Mismatches don't pop out suddenly; they hide within the transactions all the time. Accountants reconcile bank statements with the company's accounting records, aiming to identify missing data, such as bank charges or uncleared and cleared cheques. The goal of a bank reconciliation statement is to ensure the two records match and that any discrepancies are identified and rectified.

Bank reconciliation statement - definition and meaning

The bank reconciliation statement is a financial report statement that helps companies ensure their accounting records match their bank transaction statement. The bank reconciliation statement format helps identify discrepancies between books of accounts and bank records, such as outstanding cheques, deposits in transit, bank fees, interest, or any other errors. Companies prepare their BRS daily, weekly, or biweekly to keep their books accurate with different BRS formats.

Prepare your BRS format in a clickBenefits of preparing BRS with your accounting software

Every accountant has just one wish: to account for every penny. At times, the price paid to achieve that is incomparable. Matching hundreds of e-statement entries with books of accounts tests accountants' patience. Simply put, it demands a huge amount of manual effort and attention to detail, as they are prone to errors.

Tech providers understood the stress and automated bank e-statement reconciliation with accounting software. From then on, tech-equipped accountants started doing wonders with their bank reconciliation formats. Some of the most notable benefits of preparing a BRS with accounting software highlighted by Gofrugal customers are:

Wave goodbye to errors, screen switching (between the BRS sheet and the e-statement), and rechecking calculations.

Identify missing entries in the book of accounts with a click.

Save up to 90% of effort spent on reconciliation.

Prepare your own bank reconciliation statement format.

The importance of a bank reconciliation statement

Mismatches in balances can consume time in various ways. To prevent spending time identifying these mismatches, a bank reconciliation statement provides details on where and why the discrepancies occur. Below are a few instances where mismatches commonly happen, resulting in the expenditure of your valuable time.

Cheque issued but not presented

These are cheques that were issued but have not been cleared by the bank. If the status for these aren't updated in the books, mismatches would emerge. At times, the receiver could have forgotten to deposit the cheque too.

Bank charges or interests

Until you check bank e-statements, you wouldn't know about these incidents because banks don't notify users about these via SMS.

Cheque deposited but not cleared

Cheques received from a third party or contra-cheque transactions do not clear instantly. Forgetting to update these when they do clear will cause chaos in your books.

Date mismatches

If the cleared cheque date in your books is different from the actual cleared date, especially in the case of post-dated cheques, it's nearly impossible to find and reconcile.

Even after recording all the payables and receivables, the above will not let your actual bank balance in the e-statement match the bank balance in your books. Apart from spending time identifying the mismatches, preparing your bank reconciliation statement format will help identify stale cheques and track every penny that moves in the company.

The above situations are terrifying when they happen. It's better to stop these from happening instead of trying to fix the issues they cause.

Why should you choose Gofrugal for preparing your bank reconciliation statement?

Utilizing Gofrugal for bank reconciliation statement preparation enables businesses to streamline their reconciliation process by leveraging the following specialized features.

Auto BRS

The auto bank reconciliation statement feature downloads the bank e-statement and can upload it directly into your accounting software. Entries made in the software will get matched with the e-statement entries uploaded as a statement, and the cleared date will be updated automatically.

Learn howOne-click BRS

Gofrugal went a little further and partnered with ICICI Bank to simplify banking operations. Customers can now download their e-statement within the software and reconcile transactions and find out mismatches with one click. The effort spent handling mismatches has become negligible with this integration.

Learn howOne of the most tiring tasks is preparing the BRS format. With this process going from a multi-step ordeal to one step, imagine how Gofrugal can automate other processes in your business. Experience the FREE trial of Gofrugal ERP and other apps for a full month to see exactly what it can do.

Grab your free trialOverview of bank reconciliation statements

What is a bank reconciliation statement (BRS)?

A bank reconciliation statement (BRS) is the financial statement prepared after tallying the balance in the company's accounts book with that of the bank balance. The BRS assists in ensuring the accuracy of the recorded transactions in the company's accounts book aligning with that of the bank e-statement for a specified time frame.

What is the bank reconciliation statement format?

The BRS format typically includes the bank balance as per the statement, the book balance, cheques that were deposited or issued but uncleared, and the adjustments made to reconcile the two balances.

How do I generate a bank reconciliation statement easily?

BRS can be generated easily with accounting software connected to your POS, which reconciles the bank statement with the books of accounts.

How does Gofrugal help in generating a bank reconciliation statement (BRS)?

Once the BRS is prepared, the book of accounts becomes accurate. Gofrugal's integrated accounting software eases the generation of bank reconciliation statements with its special feature: Auto BRS. With the auto-BRS feature, all you have to do is upload your bank statement to the accounting software and Gofrugal will automatically match your transactions in your books of accounts with the bank statement and reconcile the transactions.

Try Gofrugal BRS for free