Trusted by thousands of businesses

Reasons why distributors need credits and outstanding balance management software

Extending credit is an essential aspect for distributors to stay afloat, but it also brings its own challenges. The right management software can help through specific features and capabilities.

Setting limits

Enables distributors to establish credit limits for individual customers, ensuring credit extended aligns with the distributor's financial capacity.

Tracking outstanding payments

Facilitates tracking of outstanding balances owed by customers across various time periods, providing clarity on amounts to be collected.

Reducing losses

Monitors defaulters and allows for adjusting or removing credit limits to avoid losses and safeguard margins effectively.

Set limits for financial stability

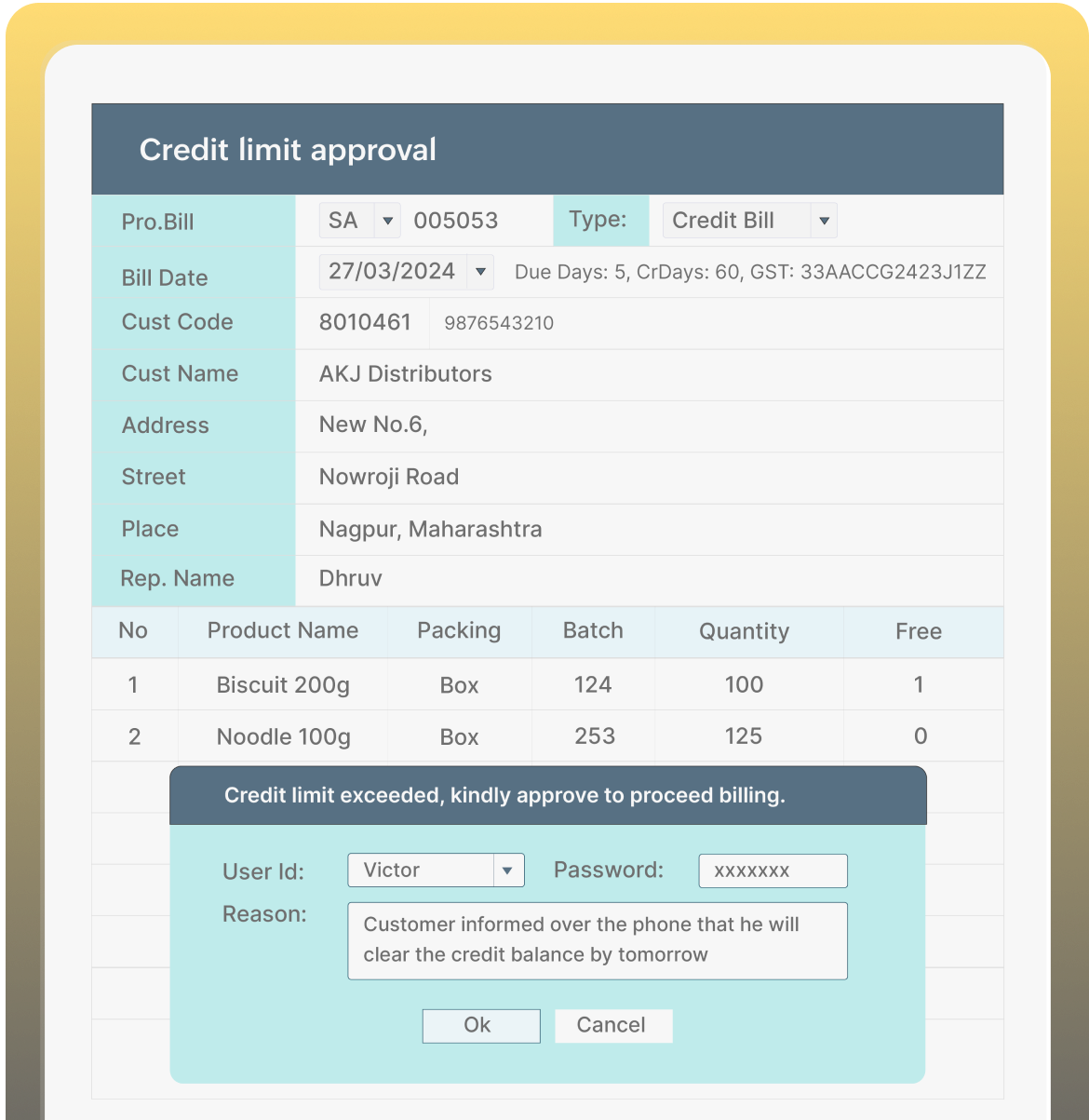

Robust approval mechanism

Cautiously override credit limits for customers who have exhausted their limits. Approve limits via mobile app with authentication through password by authorized personnel.

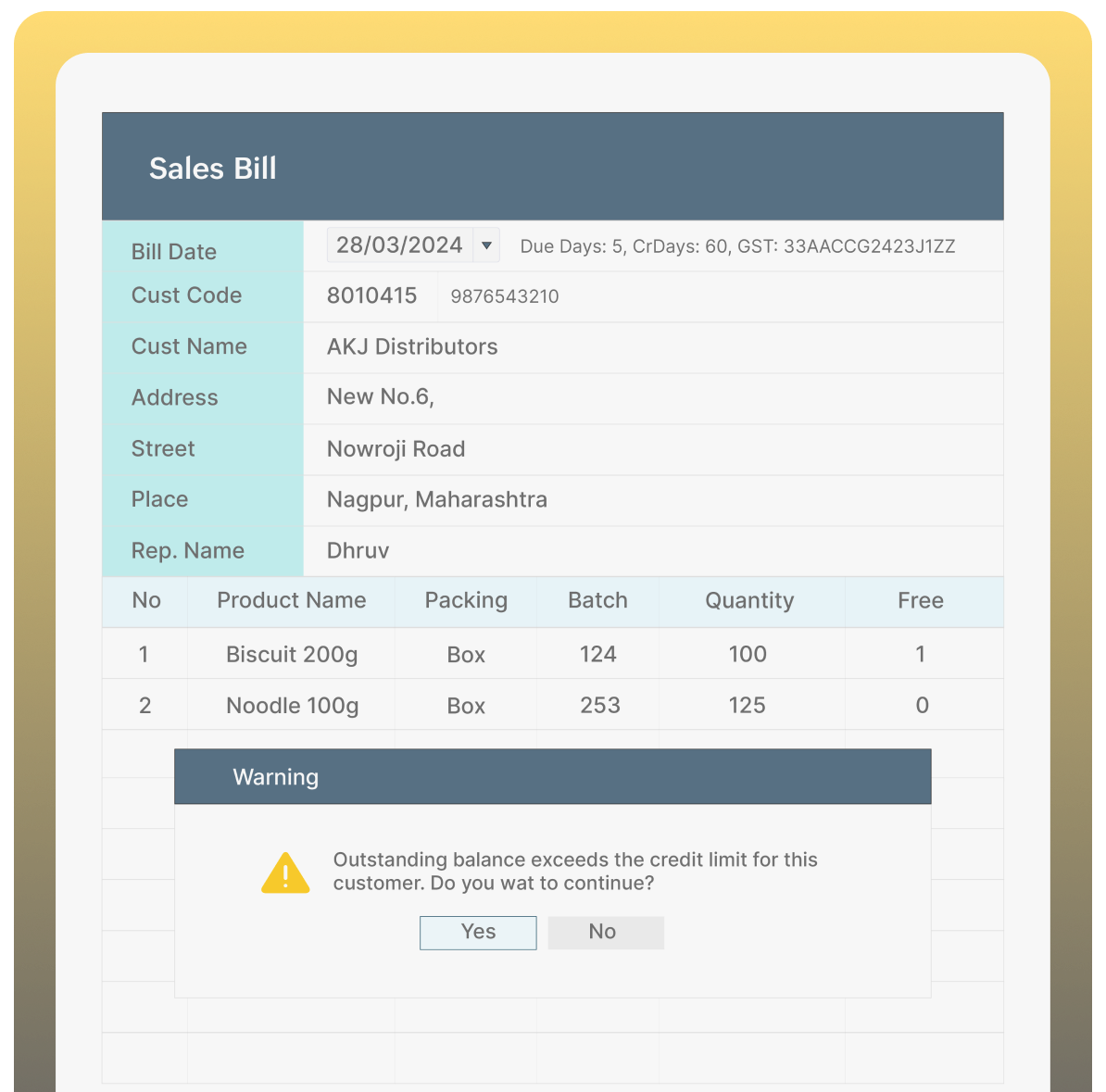

Effortless limit control

Automatically prevent users from exceeding customer credit limits, ensuring seamless management and risk control.

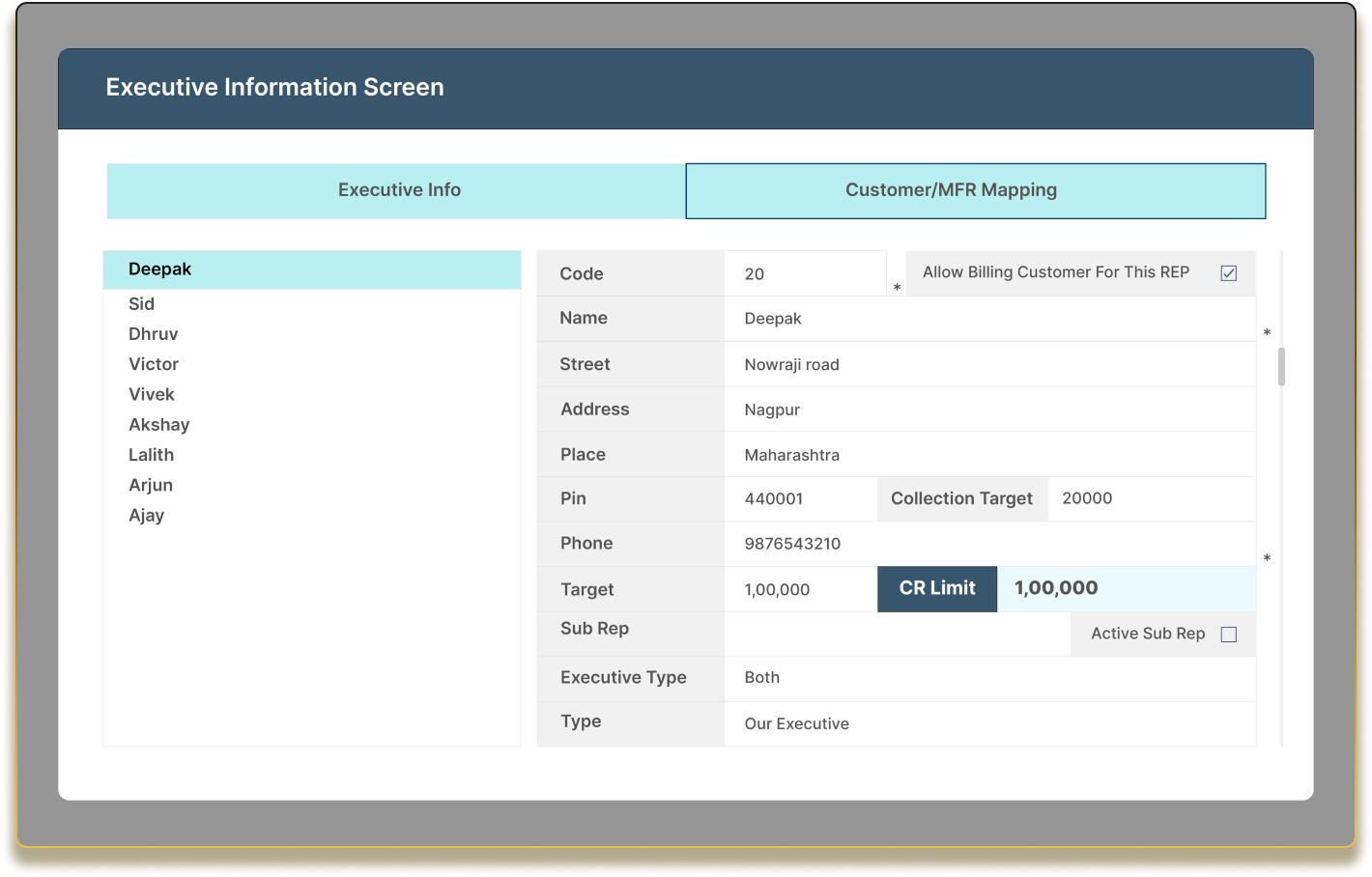

Flexible limit setting

Set credit limits based on credit value, number of bills, or number of invoices, tailored to each customer's credibility.

Tracking outstanding balances at its best

- Automated checks

- On-demand reports

- Across touchpoints

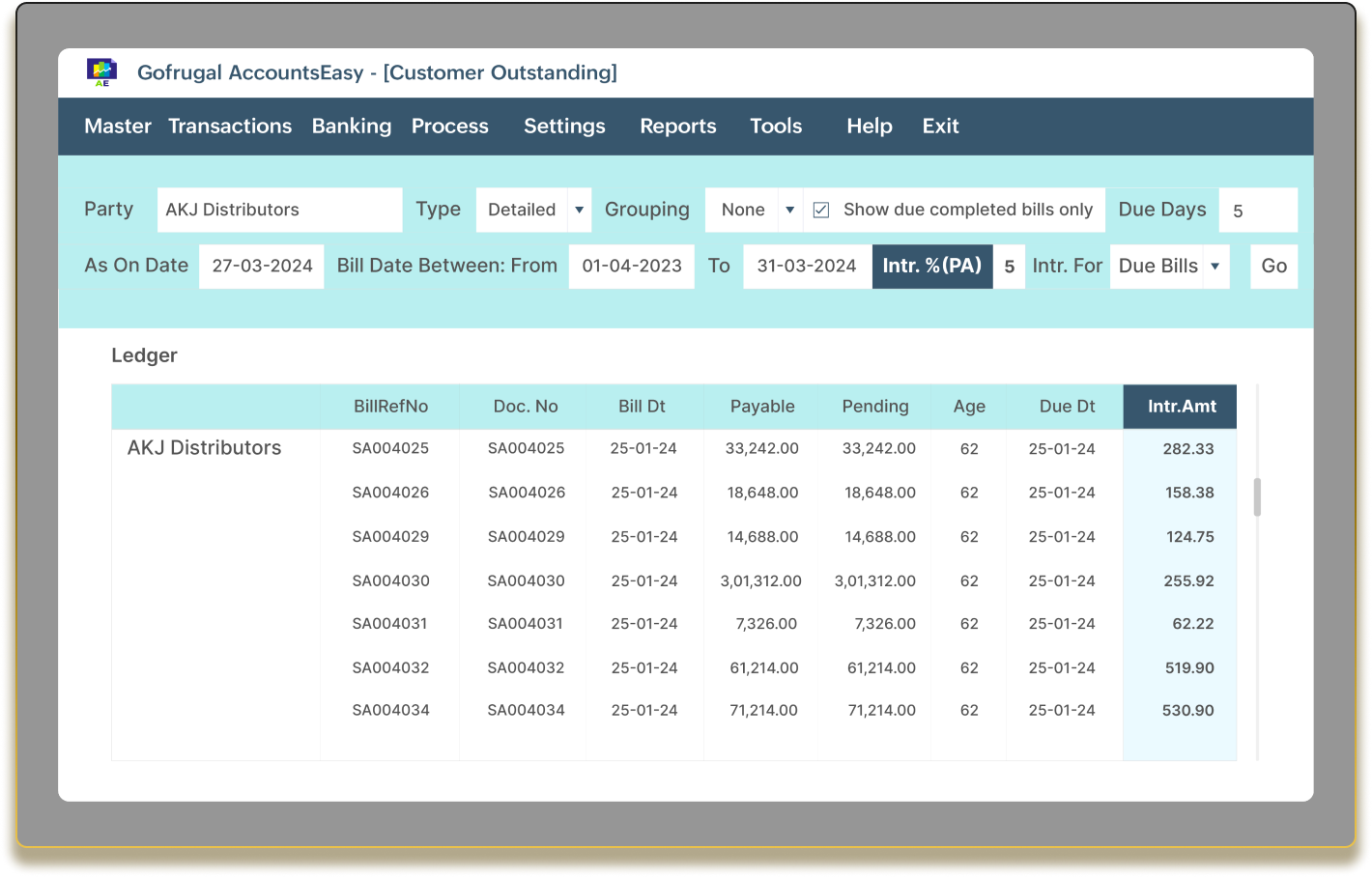

Automated outstanding balance checks

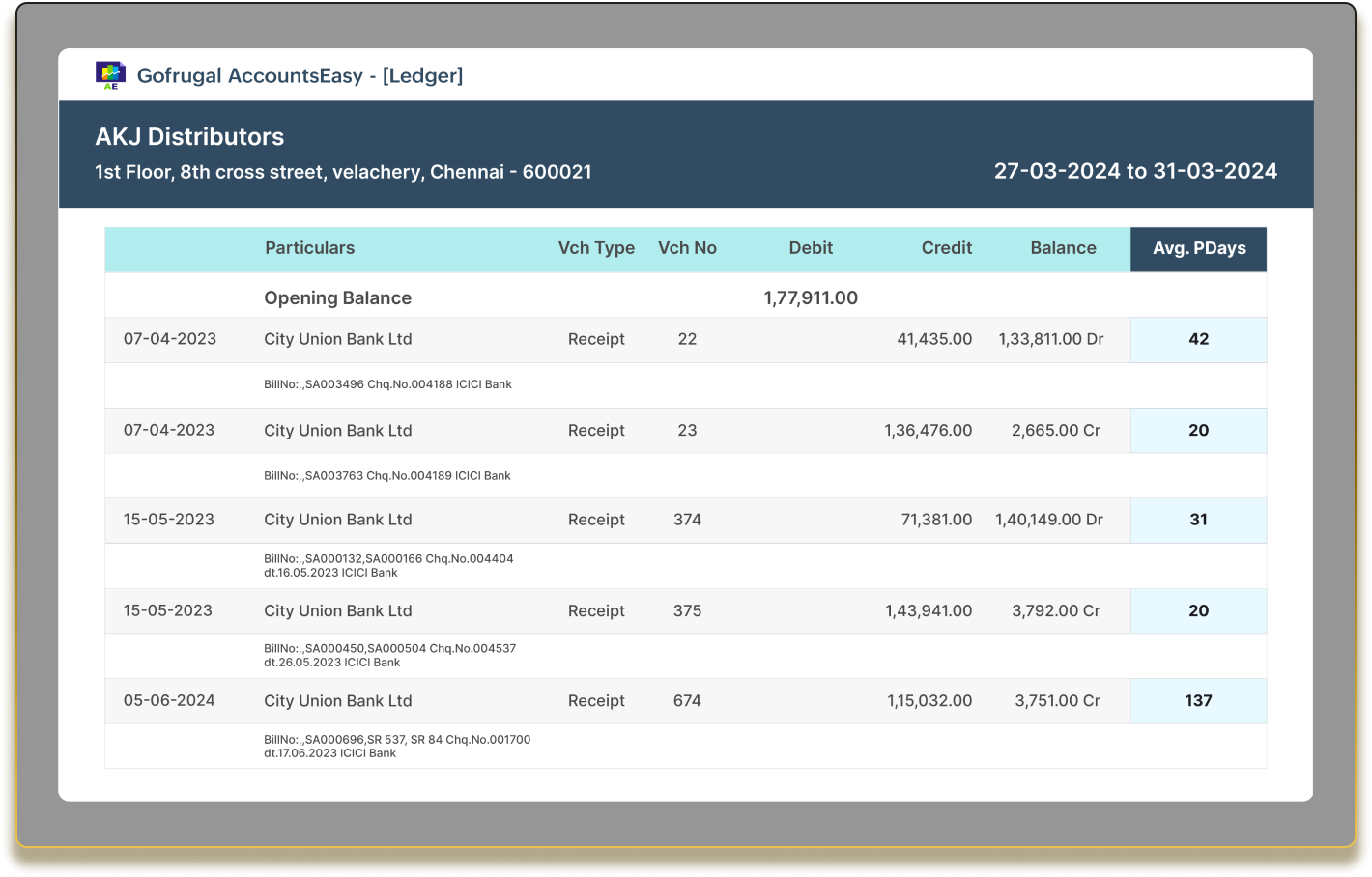

With automated processes in place, our software continuously monitors outstanding balances, providing real-time updates about each customer.

On-demand reports

Access comprehensive reports on outstanding balances in various dimensions instantly, empowering informed decision-making and proactive management strategies.

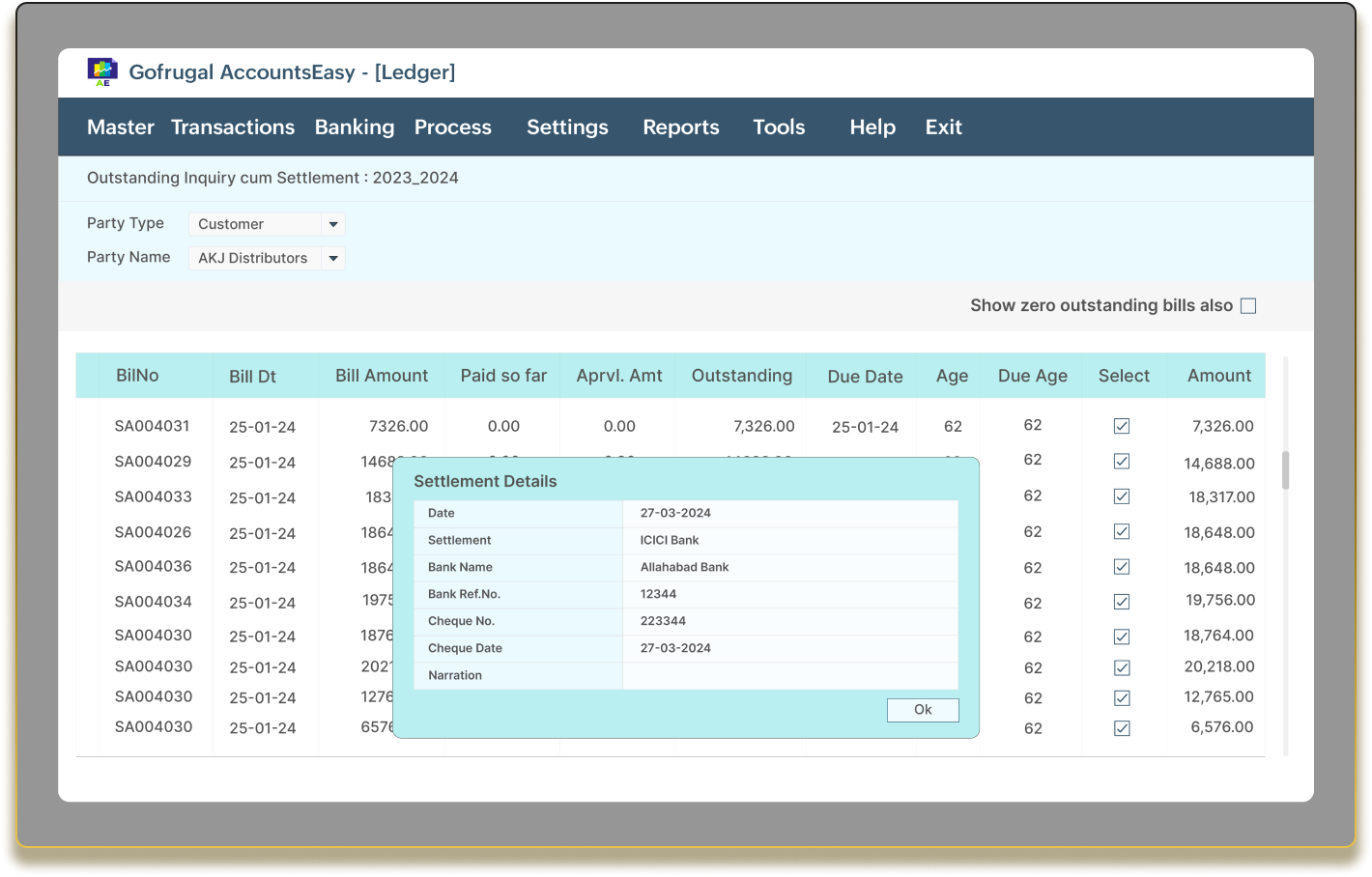

Visibility across touchpoints

Gain visibility into outstanding balances at every touchpoint of your distribution process, during sales order creation, invoicing, and payment collection.

Tailor-made features in credit management software for distributors

Interest calculation

Automate the calculation of interest charges for delayed payments to maximize potential outcomes from your capital investment.

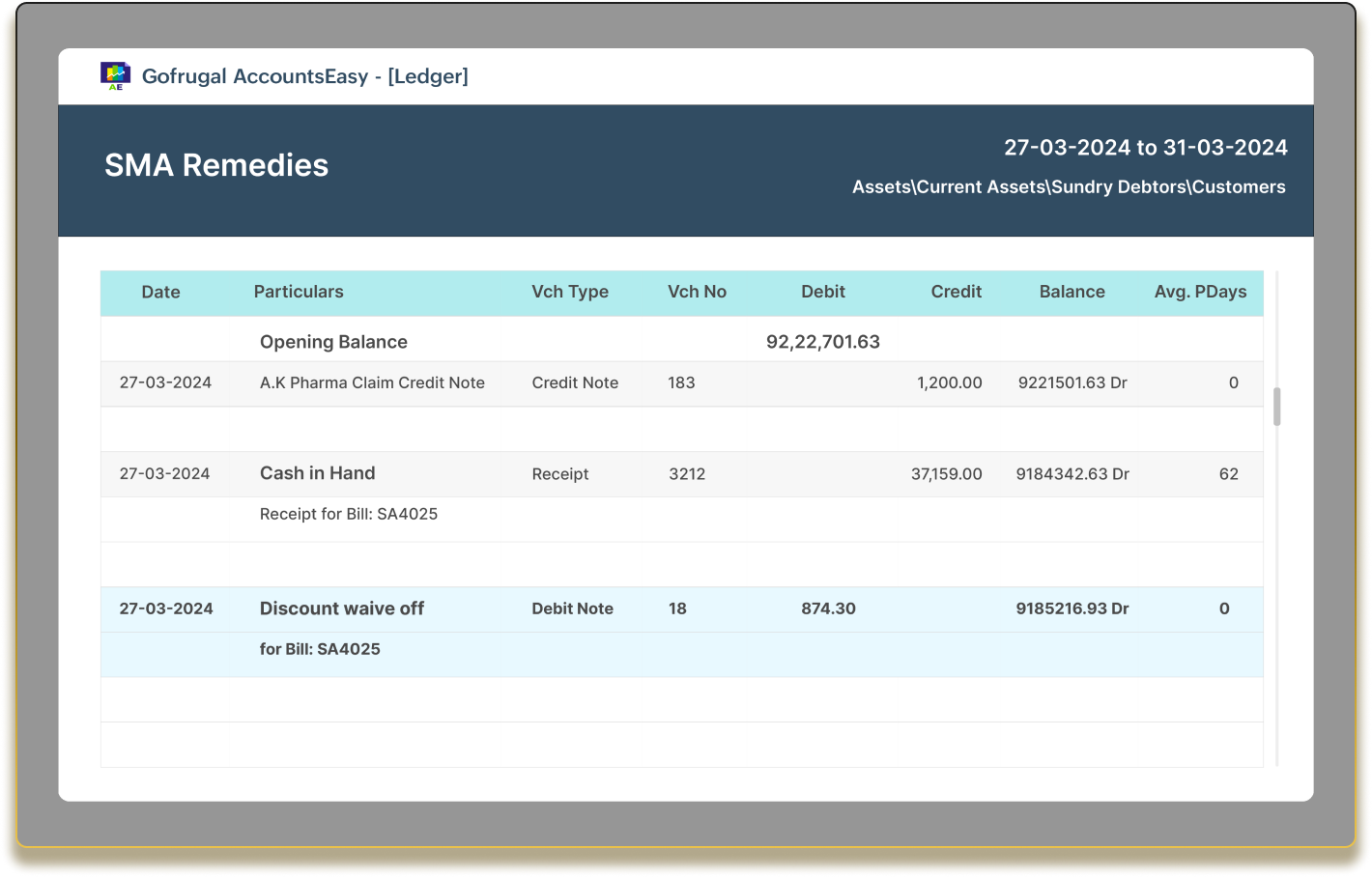

Waive off discounts

Automate the generation of debit notes for discounts issued if customers slip to complete their payment by the due date.

Credit limit for rep

Increase daily cash flow and collection by setting up credit limits for sales reps, preventing them from offering credit sales to all customers.

Average payment days

Track the average payment days of customers to gauge their creditworthiness and make informed decisions on extending credit limits in a timely manner.

Outstanding settlement

Facilitate bulk settlements for outstanding balances by selecting all transactions or specific ones for proper tracking of repayments against credits.

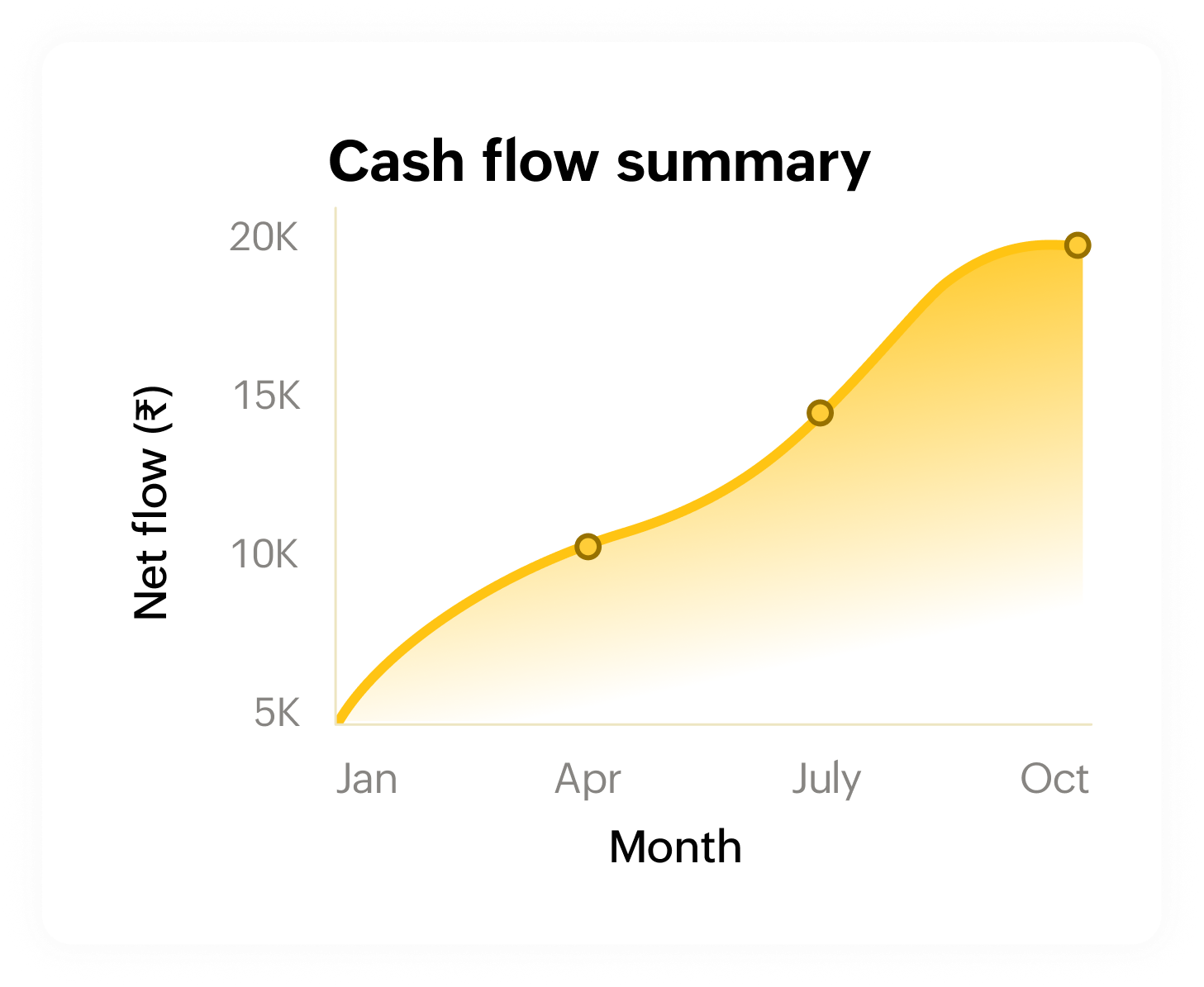

Forecast cash and fund flow for better financial planning

Get a comprehensive report on cash and fund flow to plan future expenses and investments in real time. Obtain detailed projections of the inflow to be received and the net balance for the defined timeline, ensuring smooth business operations.

Get started today!

Overview of credit management software for distributors

What is distributor credit and outstanding balance management?

The processes and systems of distributors that are put in place to effectively manage their customers' credit limits, outstanding balances, and overall credit risk are called credit and outstanding balance management.

Market credit is an added advantage of a distributor, but poor visibility on the credit exposure and outstanding balances leads to bad debt and loss. That's where credits and outstanding balance management software come into play.

How much does Gofrugal distributor credit management software cost?

Our credit management software for distributors is a fully loaded ERP solution consisting of every module including order management, credit control, outstanding balance management, accounting, interpreting impactful insights, inventory management, and returns management.

Additionally, our distributor credit management software is available in three different editions, tailored to businesses ranging from SMEs to large-scale supply chain industries. Compare the Editions and pricing to find the perfect fit for your business.

What features are included in Gofrugal distributor credit management software?

Common features of distributor credit management software may include:

- Credit limit setting - Establishing credit limits for individual customers based on their risk profile and financial standing.

- Customer credit analysis - Assessing the creditworthiness of customers based on their financial history, payment behavior, and relevant factors.

- Automated credit approval - Streamlining the credit approval process with automated workflows to expedite decision-making during exceptional scenarios.

- Credit monitoring - Tracking customer accounts to identify deviations from agreed-upon credit terms or potential payment issues.

- Credit reporting and analysis - Generating reports and analytics to assess the overall credit health of the customer base, average payment days, and identify trends or areas for improvement.

What are the benefits of credit management software for distributors?

The benefits of using best credit management software for distributors include:

- Improved cash flow - By effectively managing credit and collections, distributors can reduce the number of outstanding balances and improve cash flow.

- Reduced risk - By assessing customer creditworthiness and monitoring accounts closely, distributors can lower the risk of nonpayments or bad debt.

- Enhanced efficiency - Automating credit processes reduces manual workloads and streamlines decision-making, leading to increased efficiency.

- Better customer relationships - Clear credit control and timely communication regarding payments can help maintain positive relationships with customers.

- Insightful reporting - Analytics provided by the software can offer valuable insights into the distributor's credit performance, payment terms, cash flow analysis, and projections.

Can I try the software before I buy it?

Absolutely! We offer a free 30-day trial of our distributor order management software. Additionally, our team of experts offers a personalized demo at no cost.

Gain complete control over credits and outstanding balances, reduce defaults, avoid bad debts, and start focusing on growing your distribution business with our credit management software for distributors.

Contact us today to learn more and revolutionize your distribution operations.