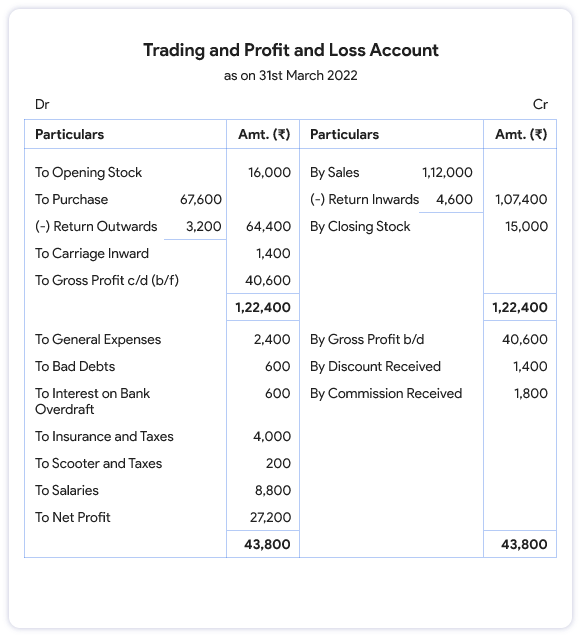

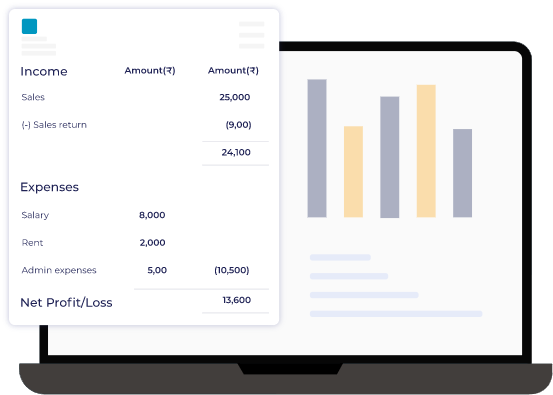

Net sales

Net sales/Revenue is the total value of money that the company generates by selling its products, and services adjusting from the returned goods value.

Net sales = Total revenue generated - Return goods value

Cost of Goods Sold

The Cost Of Goods Sold(COGS) is a direct cost incurred in producing a finished product from the purchase of raw materials for the manufacturing sector or purchase of traded items in case of trading sector till the time it is ready for sale.

Cost Of Goods Sold = Opening stock + Purchases + Direct expense - Closing stock

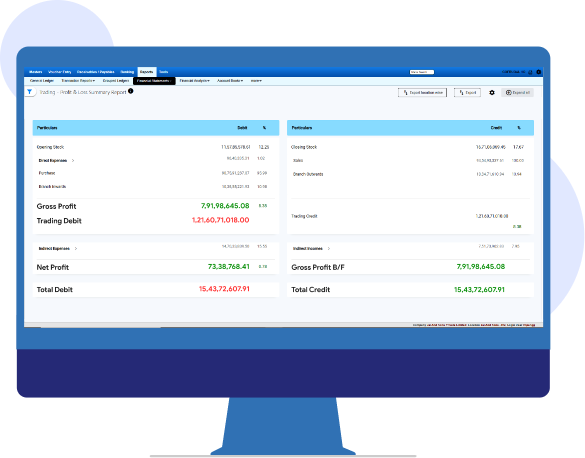

Gross Profit/Loss

Gross profit/loss = Total revenue generated by selling the products - Cost of selling the products.This helps in the easy identification of whether the selling price of the product can recover the basic procurement cost involved with a sufficient margin.

Direct Expenses

Direct expenses are expenses other than purchase costs that are directly incurred for the core business operations and it directly relates to the cost of production or acquisition of the product. Examples are freight inwards(freight on purchases), loading & unloading charges, factory wages, factory rent, etc.

Indirect Expenses

They are essential costs that are indirectly involved in the smooth operation of business. Examples are administrative salaries, office rent, depreciation, office stationers/maintenance, insurance, advertisement, salesman commission, and much more.

Net Profit/Loss

Net profit is the actual profit or loss that a business has made over a financial period adjusting the indirect expenses and indirect income from the gross profit. This actually helps in easier identification of whether the business can generate returns from the investment made and detect where the business lags in generating profits.