Touted to be one of the two greatest changes in the Indian economy in the last few decades, GST (the other one being Demonetization) had a lot of buzz surrounding it ever since August 3rd, 2016, the day it was announced. While the government officials are still in talks to amend GST, here are 7 things that any retailer/businessman should know about GST.

1. What is GST?

GST (Goods and service tax) is the most awaited tax reform post independence. GST aims to bring uniformity and predictable tax regime throughout the country. It enables fewer compliance burdens for the businesses, transparency in transactions, widening the tax coverage. Faster movement of goods, balanced tax for goods and services.

In simple words, it would introduce two-tiered One-Country-One-Tax regime.

2. Who will benefit out of GST?

Owners with businesses pan-India will have a lesser cost of compliance since they would pay only one tax. Retail businesses will benefit the most as there would be a seamless movement of goods, better logistics, and improvement in the supply chain. Retailers across sectors will be benefited on increased consumption as there will be a reduction in tax on essential and basic items.

3. Who will be affected out of GST?

Non-compliant businesses will be affected. Retail businesses or suppliers who fail to comply with GST will find it hard to survive in the market. This is because none of his customers will be ready to be associated with the non-compliant since the system is transparent. The purchase tax credits will be allowed only if it matches with supplier returns.

The tax percentage on the imported goods, luxury goods, some of the retail goods and services is anticipated to increase from 14% to up to 20%. The compliance costs might also see a slight rise since there will be a dual control over businesses by both the Central and State Government.

4. How does it impact the overall economy of India?

- It is predicted that an overall economic growth of at least 2% is anticipated once GST is implemented.

- It would subsume all indirect taxes at the center and the state level.

- It would not only widen the tax regime by covering goods and services but also make it transparent.

- It would free the manufacturing sector from cascading effect of taxes, thereby improving the cost-competitiveness of goods and services.

- It would bring down the prices of goods and services and thereby, increase consumption.

- It would create a business-friendly environment, thus by increase tax-GDP ratio.

- It would enhance the ease of doing business in India.

5. How is the current tax structure going to change?

GST brings all indirect taxes levied by the Central and State governments under one roof. Some of the taxes getting replaced by GST include:

- Excise Duty

- VAT

- CST

- Service Tax

6. What should be my next step?

Of the estimated 8 million registered businesses under the VAT regime, around 90 per cent are SMEs. The GST applies to businesses with a turnover of Rs 20 lakh or more per month. As a businessman or a retailer, your next step should be to do the following:

- Register yourself for GST

- Take your accounts and sales processes digital

- Consult your tax consultant or auditor on the process changes required

- Interact and ensure that all your vendors and customers are registered and compliant

- Non-compliance by them increases your tax burden

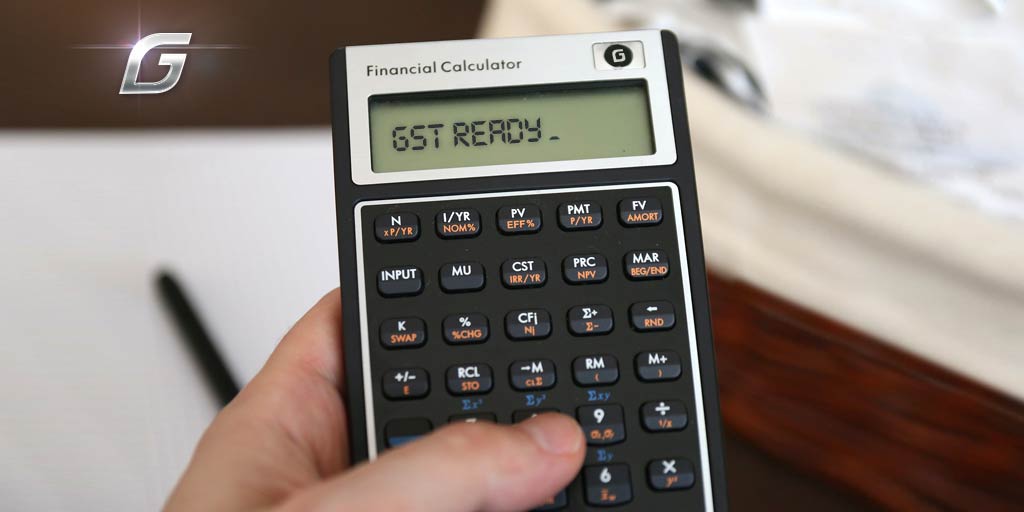

7. Is my business GST ready?

In order to know whether your business is GST ready, just make sure you tick all the boxes in the below checklist:

- Are all my business transactions recorded in my system while carrying out the transactions?

- Does the business transaction records cover 100% of my transactions including credit notes, debit notes, sales/purchase returns, schemes etc?

- Do I have all the required information about my suppliers & my B2B customers like their PAN number, their GST registration number etc?

To summarize, one should review the complete business process, the system, and tools used to ensure all business transactions are 100% accurately recorded in a timely manner to prepare the business for GST.

With nearly 70 percent of small businesses in the country are yet to adopt digital technology in their business format, it is going to be a huge challenge for them to computerize themselves in the shortest period.

Written in collaboration with Krishna Prasath.