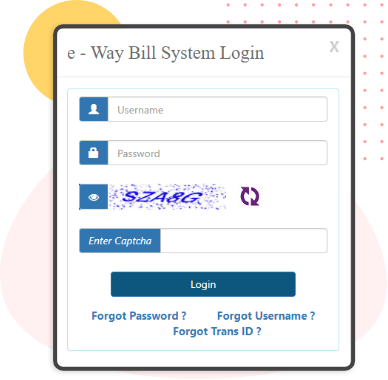

Step 1: Register

Register your mobile number for SMS on the GST e-way bill portal. The registered mobile number for that particular GST number and user ID can only be used to generate an e-way bill by SMS.

Step 2: Send and Validate

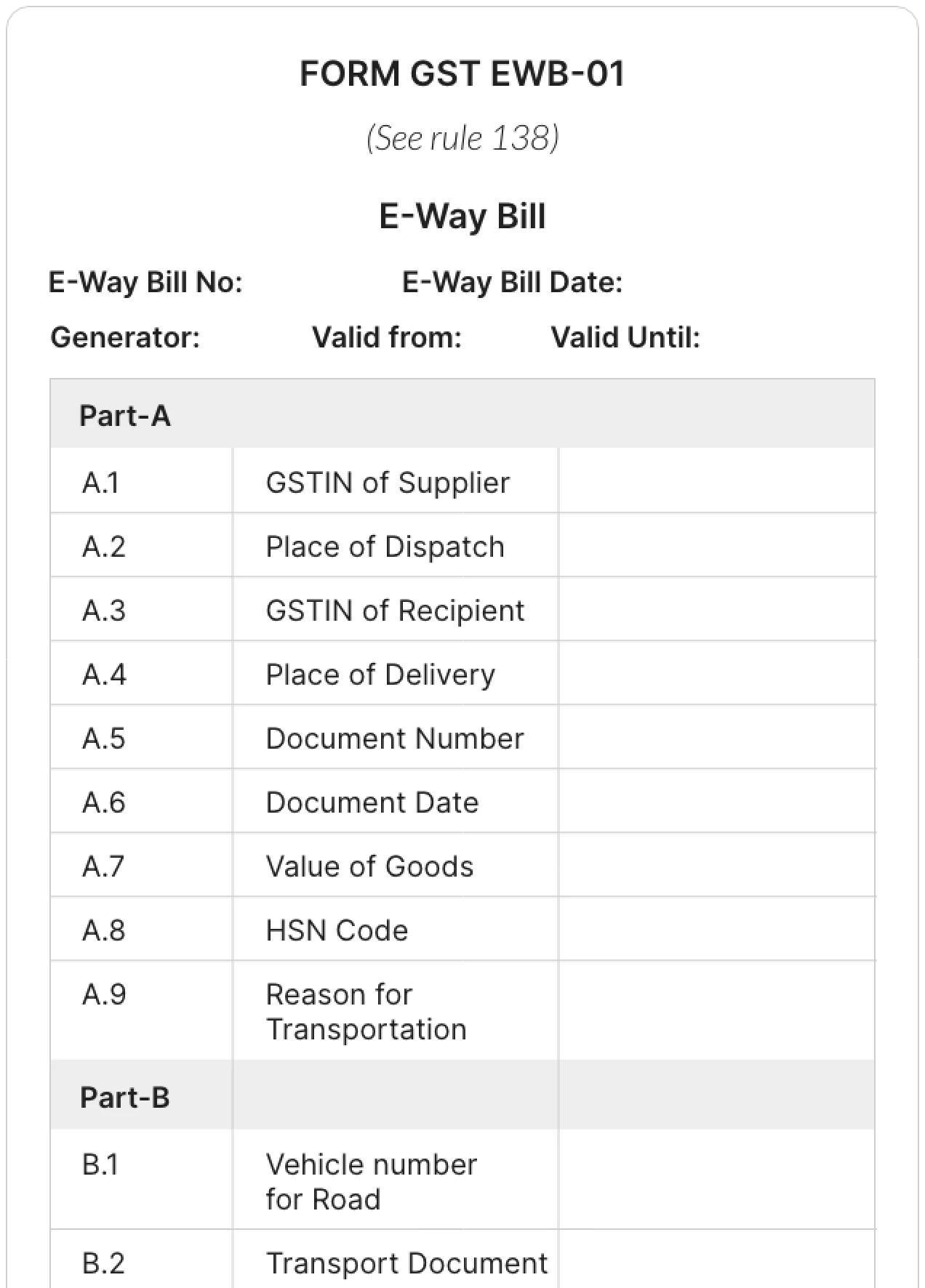

Send an SMS with the format and parameters specified in the GST way bill portal to the e-way bill number 77382 99899.

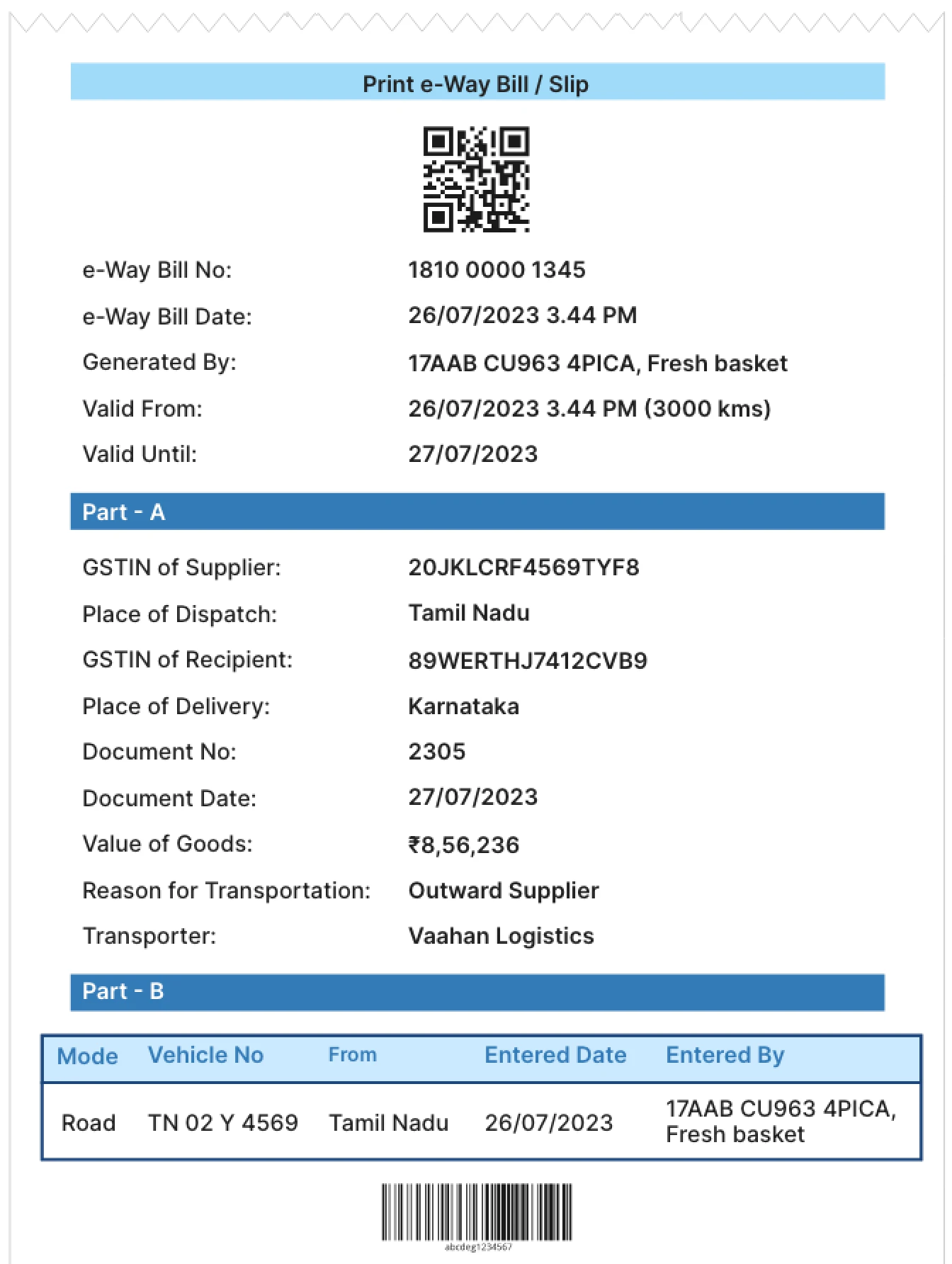

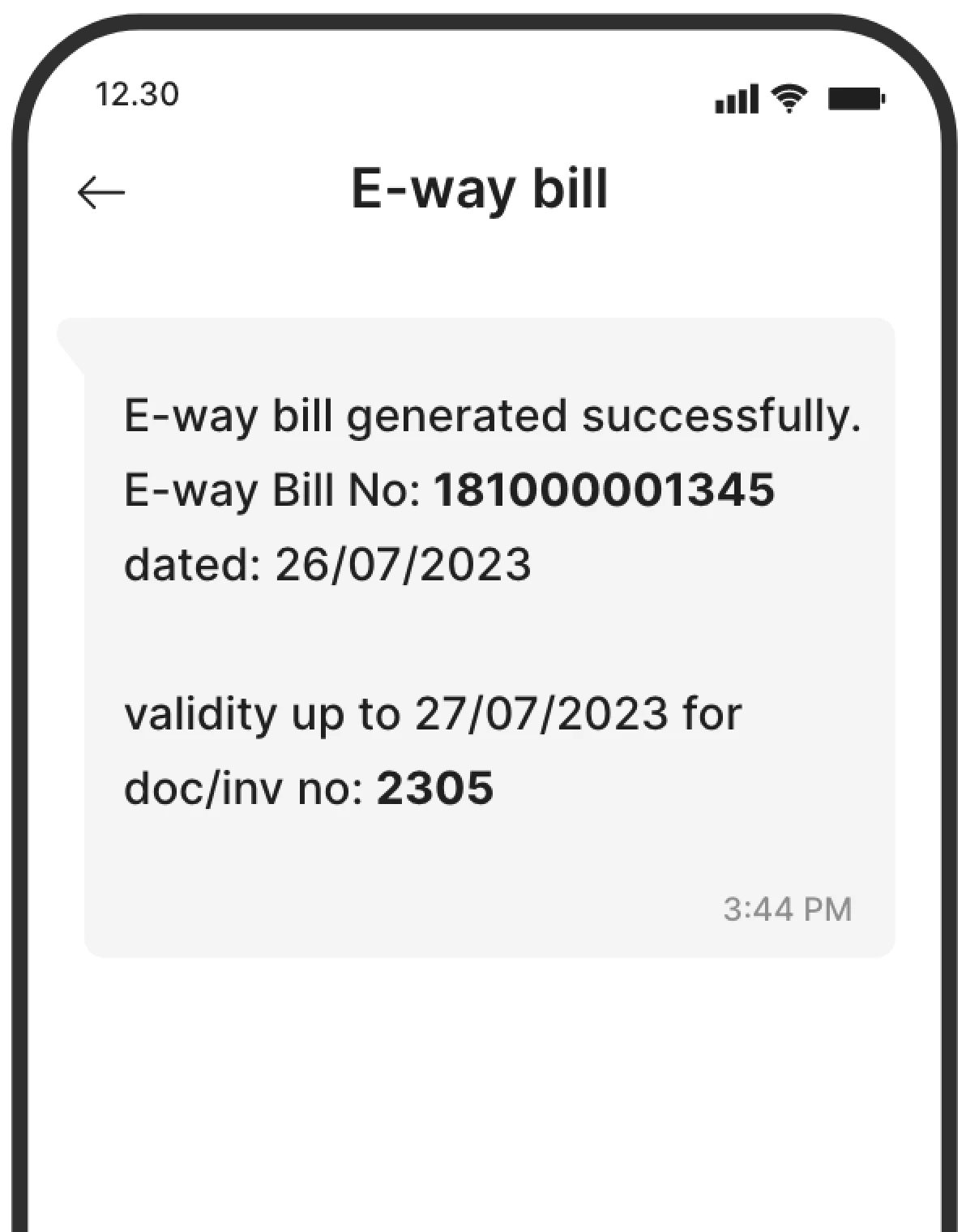

Step 3: Receive EBN

When the message is sent, the EBN will be produced together with the transporter data, and it will be communicated to the user through SMS.