Key features

Key takeaways

- Inventory is not stock, it is blocked working capital.

- Fast-moving items are not always profitable items.

- The right inventory decisions improve profit without increasing sales.

Importance of inventory reports in retail profitability

Inventory reports play a critical role in improving retail profitability because inventory directly impacts working capital, cash flow, and margins. For most retail businesses, inventory is the largest investment and the biggest source of hidden losses.

By analyzing inventory reports regularly, retailers can:

- Control overstocking and prevent dead stock.

- Reduce losses from aging, expiry, and stock mismatch.

- Align purchasing with real customer demand.

- Improve cash flow without increasing sales pressure.

- Make informed decisions on pricing, promotions, and clearance.

Key inventory reports retailers should analyze

Retailers don’t need to review dozens of reports to manage inventory profitably. Focusing on a few high-impact inventory reports provides clear visibility into stock health, demand patterns, and cash efficiency. The key inventory reports retailers should analyze include:

- Stock summary and Inventory valuation reports to understand stock investment.

- Fast and slow moving reports to identify demand trends.

- Stock aging and expiry reports to prevent inventory losses.

- Purchase vs. Sales reports to correct buying behavior.

- Inventory Turnover and Efficiency Reports to measure stock performance.

How to look at inventory reports for profit

View inventory as blocked capital

Report: Stock Summary Report, Inventory Valuation Report

Most retailers focus on how many items are in stock. Profitable retailers focus on how much money is locked in stock.

- Look at inventory value, not quantity.

- Identify which categories are holding the maximum money.

- Find areas where cash is blocked but sales are low.

- Shift investment toward categories that sell faster and return cash.

Business insight: If 70% of your inventory value comes from a category contributing only 30% of sales, your money is in the wrong place.

Evaluate fast-moving items beyond sales speed

Report: Fast & Slow Moving Items Report

- Fast-moving does not always mean profit-making.

- Combine movement data with margin and shelf-life.

- Identify fast movers with low margin or high expiry risk.

- Control reordering of items that sell fast but reduce net profit.

Business insight: Some items sell daily but leave little money after discounts, handling, and waste.

Use stock aging as a loss-prevention tool

Report: Stock Aging Report

- Stock does not become a loss overnight; it turns risky as it stays unsold longer.

- Stock aging reports show how long items remain in inventory (30, 60, 90+ days).

- Aging slabs help identify items entering the loss or expiry risk zone early.

- Timely actions like discounts, bundling, or promotions help recover cash and prevent losses.

Business insight: A small discount today is better than a full write-off tomorrow.

Analyze buying behavior using purchase vs. sales data

Report: Purchase vs. Sales Analysis Report

- Buying based on intuition is one of the biggest reasons retailers face cash pressure.

- When purchase quantities are not aligned with actual sales demand, excess stock starts blocking working capital.

- By comparing what you buy with what actually sells, you can clearly see overbuying patterns, slow-moving purchases, and repeated buying mistakes.

- This helps reduce bulk purchases that lock money up for months and brings discipline into buying decisions.

Business insight: If purchases grow faster than sales, cash flow will suffer even if sales look healthy.

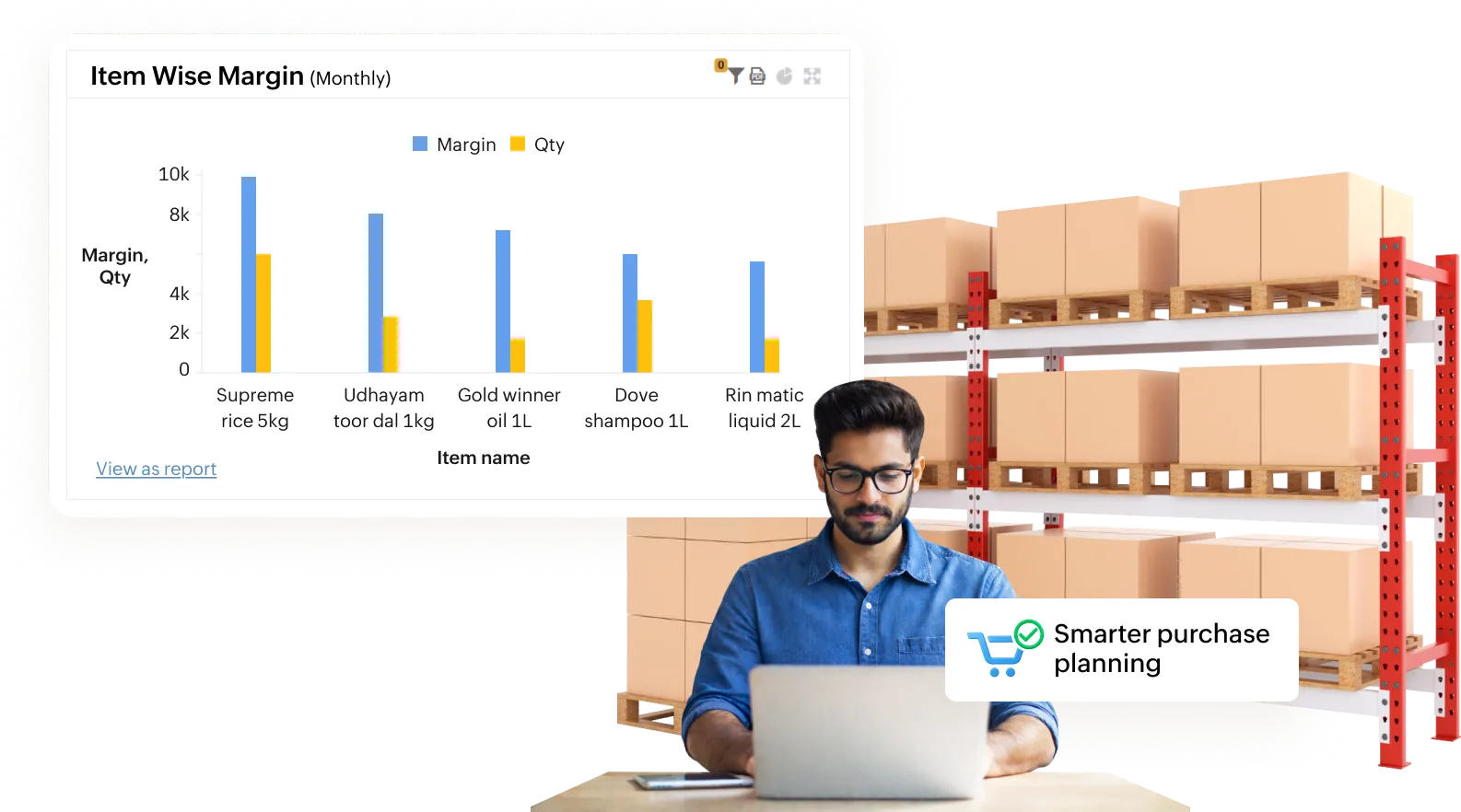

Prioritize margin along with movement

Report: Sales Analysis Report, Item-wise Margin Report

- High sales volume does not always mean high profit.

- Some items sell fast but contribute very little to the bottom line.

- By comparing how quickly an item sells with how much margin it generates, retailers can identify products that truly drive profit.

- This insight helps optimize shelf space, focus on better-margin items, and adjust reorder budgets based on profit contribution not just sales speed.

Business insight: One high-margin item selling steadily is often more valuable than multiple low-margin fast movers.

Decide which inventory deserves reinvestment

Report: Inventory turnover Report, GMROI/Stock Efficiency Report

- Not every product deserves repeat orders. Some items consume capital without giving healthy returns.

- By analyzing speed of movement, margin earned, and aging risk together, retailers can identify which items bring money back quickly.

- This helps reinvest only in inventory that performs well and reduces capital allocation to non-performing or risky items.

Business insight: Profit comes from reinvesting in items that rotate cash, not just sell once.

Treat stock variance as profit leakage

Report: Stock Variance & Adjustment Report

- Inventory loss directly eats into net profit, even though it may not appear in daily sales reports.

- Stock variance caused by damage, theft, wrong billing, or process gaps slowly leaks profit.

- Tracking and analyzing these variances helps improve stock accuracy, fix operational issues, and reduce hidden losses that silently affect profitability.

Business insight: A 2% stock loss equals 2% profit loss; no business can afford that.

Balance inventory across stores before buying more

Report: Multi-Store Inventory Report, Store-wise Stock Summary Report

- In multi-store businesses, it’s common to buy new stock while excess stock sits unsold in another location.

- By identifying store-wise stock imbalance, retailers can move inventory through inter-store transfers instead of making fresh purchases.

- This improves stock utilization, reduces unnecessary procurement, and frees up blocked capital without increasing inventory.

Business insight: Stock transfers are cheaper than fresh purchases.

Track inventory value trends against sales growth

Report: Inventory Valuation Trend Report, Sales Trend Report

- Inventory growth is healthy only when sales grow faster than stock value.

- When inventory increases faster than sales, it signals capital inefficiency.

- By tracking inventory value trends alongside sales growth, retailers can spot early warning signs of cash blockage and control buying before cash pressure builds up.

Business insight: If inventory value rises faster than sales, profit will shrink.

Measure inventory efficiency, not just availability

Report: Inventory Turnover Report, Stock Efficiency/GMROI Report

- Simply having stock available does not guarantee profit.

- What matters is how efficiently inventory converts into sales.

- By tracking turnover and efficiency metrics, retailers can improve capital rotation and generate higher profit without increasing sales volume.

- Efficient inventory creates profit through smarter usage, not higher stock levels.

Business insight: An item with lower margin but high turnover can outperform a high-margin slow seller.

Common mistakes retailers make when reading inventory reports

Even after using POS or ERP software, many retailers misread inventory reports and make decisions that quietly hurt profit. The problem is not lack of data, it is how the data is interpreted.

- Looking at numbers without knowing what action to take: Retailers see stock figures but don’t translate them into buying, pricing, or clearance decisions.

- Reading reports in isolation instead of connecting them: Stock, sales, aging, and margin reports are viewed separately, leading to incomplete business decisions.

- Assuming fast-moving items are always profitable: High sales speed often hides low margins, high expiry risk, or heavy discounting.

- Reacting to aging and expiry only after losses appear: Reports are checked late, when stock has already lost value or become unsellable.

- Allowing inventory value to grow faster than sales: Retailers track sales growth but ignore rising inventory value, which slowly blocks cash flow.

How Gofrugal’s inventory reports help retailers turn a profit

Gofrugal’s inventory reports help retailers see inventory as money, not just stock. The reports bring together stock movement, value, aging, margin, and demand so business owners know where cash is stuck, where profit is leaking, and where to invest next.

- See where money is stuck and where it is moving: Gofrugal shows stock value, movement, and category performance together to help retailers shift money from slow, non-performing stock to items that sell faster and return cash.

- Catch losses early before they hit profit: Aging and expiry reports highlight risky stock in advance, giving retailers time to clear, discount, or prioritize sales before inventory turns into a loss.

- Buy only what will sell, not what feels right: Reorder and purchase vs. sales reports help retailers plan buying based on actual demand, reducing overbuying and improving cash flow.

- Use existing stock better across stores: Multi-store visibility helps retailers transfer stock instead of buying new, reducing excess inventory and unnecessary purchases.

- Turn inventory into faster cash, not dead stock: Turnover, efficiency, and variance reports show how effectively inventory converts into sales, helping retailers improve profit without increasing sales volume.