|

The promise of February is here! |

The month that whispers of new beginnings and the spark of hope. As January fades into the past, February sweeps in, reminding us that time waits for no one. It's a month filled with opportunities waiting to be seized, dreams ready to be pursued, and goals eager to be achieved. That's what we bring in our latest newsletter for you! |

In this edition, we cover: |

GTM for ecommerce and online businesses Important dates for business in March A throwback to the SWAK event Key highlights about ISD in GST |

Product updates |

Product category: Customer category-based rate settings Set customized rates for specific product categories based on customer categories. This ensures access to advanced functionalities and simplifies billing processes by adjusting rates seamlessly within your existing system. Easily configure rates for different customer segments, enhancing flexibility in pricing strategies. Intuitive steps guide you through the process, ensuring quick and efficient implementation. Eliminate manual calculations and errors, ensuring precise invoicing based on predefined rates.

|

|

Go-to-market strategy for ecommerce and online businesses | Starting an ecommerce business today is relatively easy since the ecosystem for it is well-established. Once you test your product's market fit, listing it on multiple marketplaces is easier. However, brands often overlook that every platform or app has its own native customer base. So, it is important to establish your presence across multiple channels, platforms, and marketplaces to get maximum reach. -- Mr. Vipul Gupta, Director, Re'equil India | Source |

|

|

|

Is this available online too? |

|

Circle the dates, plan your promotions, and delight customers! |

|

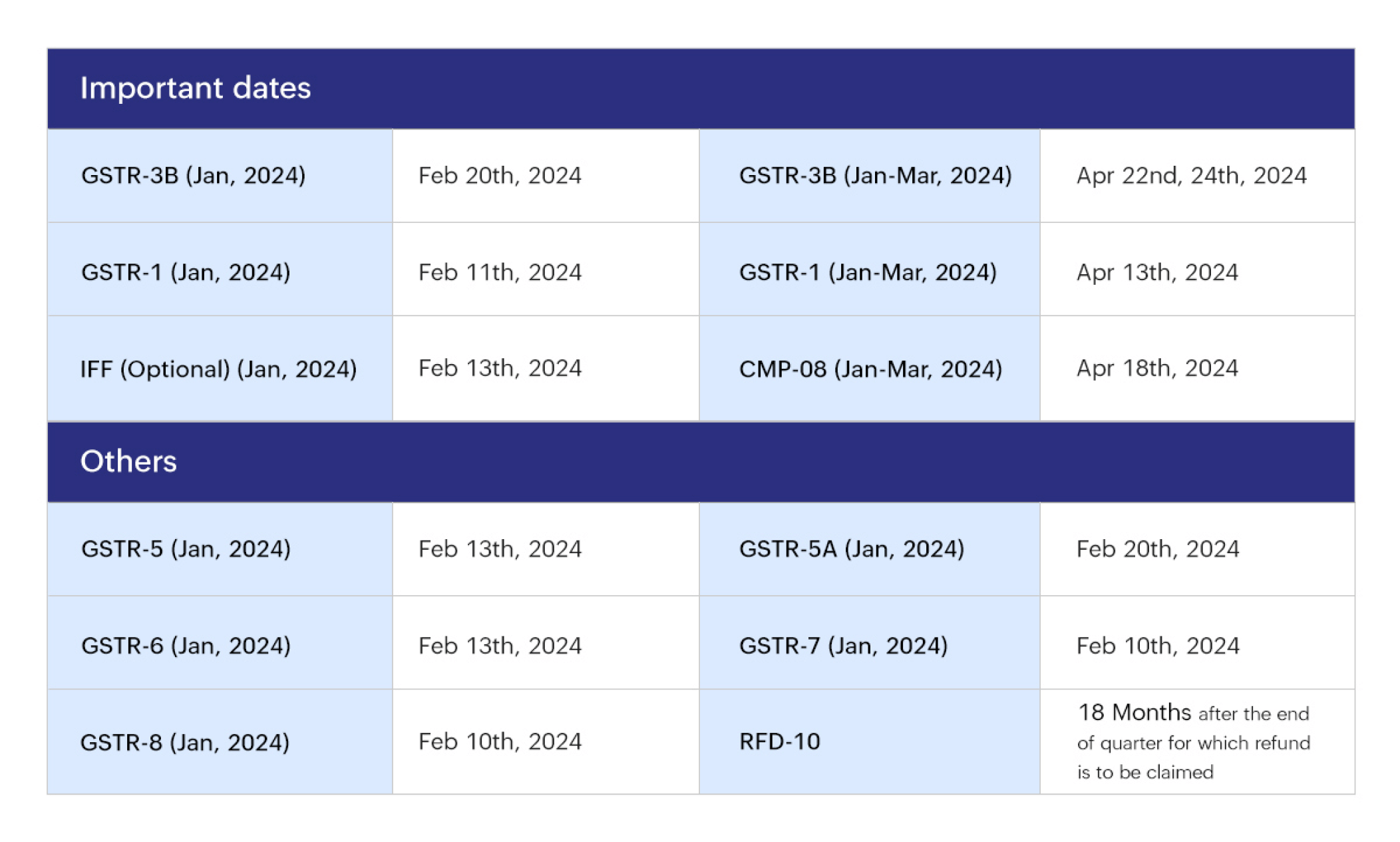

GST returns and due dates |

|

Throwback to SWAK Retail Expo 2023!We are truly grateful for the overwhelming response we received during the 2023 SWAK Retail Expo. We loved addressing 3,000+ supermarket owners and assisting them with interactive discussions, insightful suggestions, and impactful takeaways. We loved introducing our products to supermarket owners and customers to build a strong business base. Here's a quick glimpse of our experience!

If you would like us to participate in any expo organized by your business association or in your city, let us know; we are all ears. |

|

Key highlights about ISD in GSTWhat is ISD in GST? - ISD (input service distributor) is an entity that receives invoices for services received by various branches or units of a company and distributes the input tax credit (ITC) to those units based on their proportional consumption or usage of the services. This mechanism helps in the centralized management of input tax credit within a company with multiple branches or units.

- ISD involves distributing the GST credit received at the head office for common input services, such as audit fees and legal fees, to other states.

What is its applicability? - Applies to businesses with an office which receives tax invoices for input services and distributes the available input tax credit to other branch offices of the same business.

- Every company receiving common input services at the head office or any other office within the same legal entity must now distribute GST credit via ISD.

What are the action points for companies? Companies must verify and establish ISD processes, identify common expenses, inform vendors to raise invoices under ISD, and distribute the GST credit accordingly. Inclusion of reverse charge: The ISD mechanism will now cover reverse charge invoices, affecting all sectors and requiring distribution through ISD. - Centralized procurement: ISD procures services centrally for branches, triggering reverse charge liability for GST payment, such as legal or consultancy services.

- Services from unregistered dealers: ISD liable for GST under reverse charge when procuring services from unregistered dealers for its branches, akin to regular taxpayers.

- Import of services: ISD responsible for GST under reverse charge for imported services benefiting branches, sourced from abroad.

- Legal or consultancy services: ISD using legal or consultancy services for administrative purposes incurs GST payment under reverse charge.

- Services from a related party: ISD becomes liable for GST under reverse charge when receiving services from related parties, subject to reverse charge provisions.

What are the future changes expected? The basis of distribution, currently based on turnover ratio of the previous year, may be altered through rules to be prescribed later. |

|

|

Follow Us On |

|

Gofrugal is a division of |  | Corp. |

|

|