|

Hello! |

As May unfolds, we find ourselves amidst a surge of business momentum and festive spirits. The groundwork laid in the earlier months now yields plentiful opportunities, marking a time of fruition and celebration. Let's embrace this flourishing season with this edition of our newsletter to learn how to get ready for the abundance yet to come. |

In this edition, we cover: |

|

Product updates |

GST rebate support in sales and sales returns Now, customers purchasing goods from Kendriya Police Kalyan Bhandar by CAPFs, Central Police Organizations, and State Police Forces, along with their families, can enjoy the privilege of paying only half the total GST incurred in the invoice, effective from April 1st, 2024. Benefits: Simplifies the invoicing process for eligible customers by providing support to generate invoices with the applicable GST rebate directly within the application With the exempt type field set as "Tax Rebate" in the customer master, the application accurately calculates and displays the GST rebate amount during bill generation, ensuring transparency in transactions. Includes support for GST rebate amount fields in sales and sales return printouts, as well as in key reports such as the Sales - Bill Wise Detailed report and Sales Return - SR No wise Detailed report, facilitating comprehensive tracking and analysis.

|

|

Understand the changes in the cultural mindset of consumers | "As young business owners, it is important to observe the cultural mindset change happening rapidly. See these mindset changes in consumers and the cultural nuances that Indians are adapting at a faster pace to evolve your business in the current landscape." - Mr. Rakesh Kaul, MD, Livpure. | Source |

|

|

|

|

|

Circle the dates, plan your promotions, and delight customers |

|

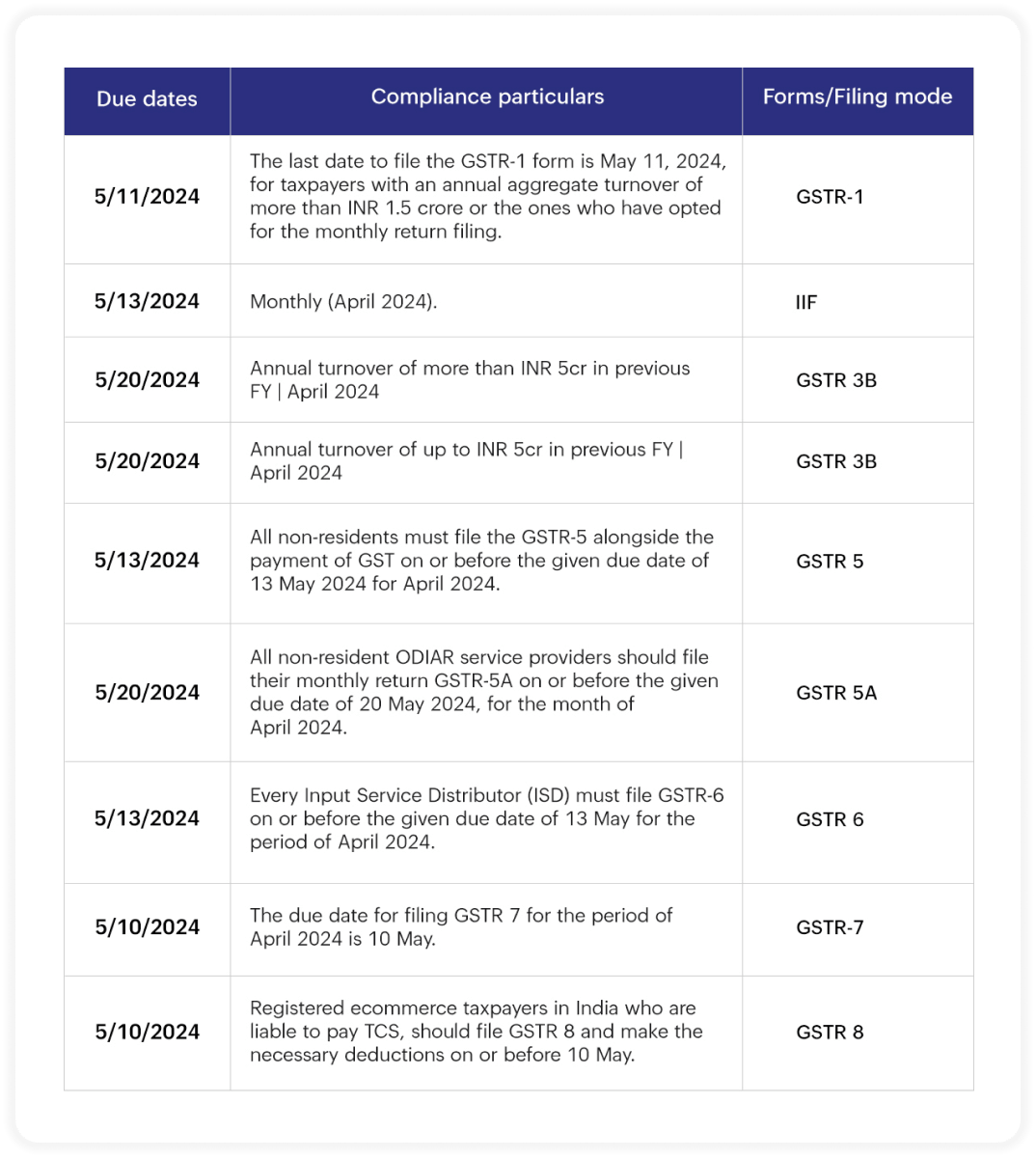

GST returns and due dates |

|

Beautech Expo 2024We are overwhelmed and delighted with the engagement and inquiries received during the recently-concluded Beautech Cosmetic and Salon Expo. We had an opportunity to learn your expectations, address your questions, and outline the importance of having an omnichannel digital solution with the vibrant crowd who visited our stall.  Want us to participate in an event near you? Just let us know! |

|

FSSAI's directive on labeling malt-based drinksThe Food Safety and Standards Authority of India (FSSAI) instructs ecommerce platforms to avoid labeling malt-based drinks as "health drinks" or "energy drinks" due to undefined terms in food laws. Mislabeling can mislead consumers; the FSSAI advises ecommerce Food Business Operators (FBOs) to correct labels for clarity and transparency. Concerns arise regarding the growing popularity of energy drinks sold by companies like PepsiCo and Coca-Cola, amid potential health risks, especially among young consumers. Vigilant monitoring and awareness campaigns are essential to address health concerns associated with excessive energy drink consumption. "Health drink" lacks standardization, while "energy drinks" are strictly designated for specific beverages under the FSS Act 2006. Source: https://www.msn.com/ |

|

|

Follow Us On |

|

Gofrugal is a division of |  | Corp. |

|

|