How to use GST Calculator ?

Gofrugal GST calculator requires four inputs to perform the GST calculations -

- Value - Enter the value on which GST is to be calculated

- Rate (%) - Select the applicable GST rate to be calculated

- Rate Type - Choose the method of GST calculation - Inclusive or exclusive

- Transaction Type - Pick up the product movement type - Inter or Intra State

After all the inputs are provided, the GST amount and its breakup will be automatically calculated by the GST calculator software tool.

Calculate GST with Gofrugal

GST - Simplified tax model for unified taxation

Government of India introduced Goods & Service Tax (GST) with effect from 1st July 2017 under the theory of "One Nation, One Tax" to achieve the principal objective of eliminating the cascading effect of taxes. Various indirect taxes happening at multiple stages of the supply chain like the Value Added Tax (VAT), Service Tax, Central Sales tax (CST), Excise Duty, Octroi were subsumed into one as GST.

Simplify GST with GofrugalWhat are the Types of GST ?

The government collects GST in four forms based on the incidence of taxation, also called the Place of supply or Destination based taxation system.

Central GST (CGST) - Central Government's 50% share of GST is charged on Intra-state or Intra-UT transactions that are sale transactions within the same state or the same Union Territory. State GST

State GST (SGST) - State Government's 50% share of GST is charged on Intra-state transactions, that is, sales transactions within the same state.

Union Territory GST (UTGST) - Union Territory Government's 50% share of the GST charged on Intra-UT transactions, which are sales transactions within the same Union Territory. As per the recent GST Council pronouncements, the following 8 regions are considered Union Territories under the purview of GST.

- Jammu and Kashmir (GST code - 01)

- Chandigarh (GST code - 04)

- Daman and Diu (GST code - 35)

- Dadra and Nagar Haveli (GST code - 26)

- Lakshadweep (GST code - 31)

- Andaman and Nicobar islands (GST code - 35)

- Ladakh (GST code - 38)

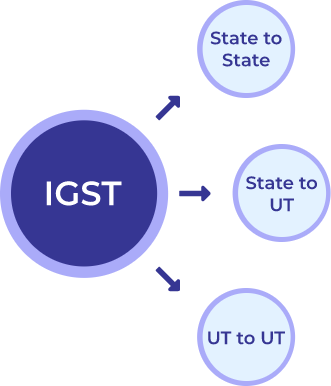

Integrated GST (IGST) - Central Government charges IGST on Inter-State, Inter-UT, import, and export transactions that are sale transactions across states and/or union territories or across countries.

Try Gofrugal for all GST needs

GST Rates in India

The GST Council of India has broadly categorized all goods & services into two tax slabs, namely 5% and 12%. In addition, there is a 0% rate (nil-rated supplies) for essential goods like fresh fruits, vegetables, milk, eggs, etc. Some of the items are exempt under the GST law (exempt supplies) like rice, wheat flour, pulses, breads, natural honey, etc do not come within the purview of the GST (non-GST supplies) like petrol and diesel.

Exports and Special Economic Zone (SEZ) supplies are treated as zero-rated supplies. Also, items like tobacco products, cigarettes, pan masala, aerated drinks containing added sugar, caffeinated and non-alcoholic beverages fall under sin goods category attracting GST of 40%.

Try Gofrugal now

How is GST Calculated?

The government's simple GST taxation policy has made it significantly simpler to calculate the necessary taxes. Based on whether the transaction is intra-state or interstate, it is now possible to determine the GST rates that apply to the various goods or services. To calculate GST, we can utilise formulas and a GST calculator.

What is GST Inclusive amount?

Inclusive method means the price determined includes the GST amount also, such that the final net price to the customer is fixed and the base value or taxable value on GST calculation has to be made. Base value or taxable value is arrived based on the reverse/back working method.

What is GST Exclusive amount?

Exclusive method means the base value or taxable value of the supply is first determined which does not include the GST amount in it. GST is calculated on this base value or taxable value and the final net price is arrived at by adding the GST amount to the base value or taxable value.

GST Calculation Formula

The taxpayer can use the following formula to calculate GST for retail shops and other businesses. The formula below can be used to calculate a product's net price after applying GST and removing GST as well.

GST Calculation Formula under Exclusive Method

In the Exclusive method, GST calculation formula is as follows: GST amount= Value of the supply x GST rate / 100 Net price= Value of the supply + GST amount The Value of the supply is also called the base value or taxable value or assessable value

For Example :

If Value of supply is ₹ 1000 and GST rate is 5%, then GST amount= 1000 x 5 / 100 = ₹ 50 Net price= 1000 + 50 = ₹ 1050

GST Calculation Formula under Inclusive Method

In the Inclusive method, GST calculation formula is as follows: GST amount= Net price x GST rate / (100+GST rate) Value of the supply= Net price - GST amount The Value of the supply is also called the base value or taxable value or assessable value

Net price is the GST Inclusive price fixed for the product or service

For Example :

If Net price is ₹ 1000 and GST rate is 5%, then GST amount= 1000 x 5 / (100+5) = 1000 x 5/105 = ₹ 47.62 Value of the supply= 1000 - 47.62 = ₹ 952.38

Conversely, to prove the above values in Exclusive method GST amount952.38 x 5 / 100 = ₹ 47.62 Net price952.38 + 47.62 = ₹ 1000

How to Calculate GST in Retail Industry?

To calculate GST, one must know the

Value of the product/service

The retailer can calculate GST by first determining the selling price of the supply in accordance with the valuation rules under GST law.

GST rate applicable for it

All goods and services are commonly categorized under a unified tax system using a Harmonized System Nomenclature (HSN) code or a Servicing Accounting Code (SAC) for goods or services, respectively. The GST Tariff table specifies the GST rate for each HSN/SAC code.

The retailer has to ascertain the HSN/SAC under which product/service supply has to be classified. Once that is finalized, then its corresponding GST rate can be easily identified.

Transaction type

Identify the from state and to the state between which product/service is supplied. If both states are the same, then the transaction becomes an Intra-state supply, and if they are different, then the transaction becomes an Inter-state supply. CGST & SGST would apply to Intra-state supplies, and IGST would apply to Inter-state supplies. Hence, determining the type of supply (inter-state or Intra-state) would help in deciding the type of GST(s) that would be applicable to the particular transaction.

Method of calculation

Select whether GST is to be calculated using the Inclusive method or the Exclusive method. According to the method of GST calculation, the formula will vary.

How to Calculate CGST, SGST, UTGST?

GST Calculation examples

As explained above, the types of GST, CGST, and SGST would apply to Intra-state transactions with an equal share to the Central and State governments. In the case of Intra-UT transactions, CGST and UTGST would apply with an equal share to the Central and UT governments. CGST rate= GST rate / 2 SGST or UTGST rate= GST rate / 2

CGST amount= Value of the supply x CGST rate / 100 SGST or UTGST amount= Value of the supply x SGST or UTGST rate / 100

Net price= Value of the supply + CGST amount + SGST or UTGST amount

Example-1 :

If Value of supply is ₹ 1000, GST rate is 5% and a transaction happens within the state of Maharashtra, then CGST rate= 5% / 2 = 2.5% SGST rate= 5% / 2 = 2.5% CGST amount= 1000 x 2.5 / 100 = ₹ 25 SGST amount= 1000 x 2.5 / 100 = ₹ 25 Net price= 1000 + 25 + 25 = ₹ 1050

Example-2 :

If the above sale transaction happens within the UT of Chandigarh, then CGST rate= 5% / 2 = 2.5% SGST rate= 5% / 2 = 2.5% CGST amount= 1000 x 2.5 / 100 = ₹ 25 SGST amount= 1000 x 2.5 / 100 = ₹ 25 Net price= 1000 + 25 + 25 = ₹ 1050

How to Calculate IGST?

Examples of IGST calculation

In the case of Inter-State or Inter-UT, IGST would apply at the applicable GST rate IGST rate= GST rate IGST amount= Value of the supply x IGST rate/ 100 Net price= Value of the supply + IGST amount

Example :

If the value of supply is ₹ 1000, GST rate is 5% and transactions happening between

- A. Maharashtra & Gujarat (a State vs another State)

- B. Chandigarh & Ladakh (an UT vs another UT)

- C. Gujarat & Chandigarh (a State vs a UT)

then IGST would apply in all above scenarios, with IGST rate = 5% GST amount= 1000 x 5 / 100 = ₹ 50 Net price= 1000 + 50 = ₹ 1050

Automate your GST classification

Importance of GST Calculation

- GST has consolidated a number of indirect taxes under one umbrella, simplifying taxation for service and commodity businesses

- GST minimizes tax cascading by offering a comprehensive input tax credit mechanism throughout the whole supply chain

- Uniform processes for submitting returns, paying taxes, and receiving refunds

- GST contributes to the reduction of tax fraud and the development of a common market with consistent taxation in India

Businesses liable to pay GST

Any business whose turnover exceeds INR 40 lakhs in a financial year is liable to get registered under the GST laws, collect, remit, and file the necessary GST returns as prescribed from time to time. This 40 lakh limit is, however, for a supplier of goods, and for a service provider, the said limit is INR 20 lakhs.

There are also some special category states like Arunachal Pradesh, Assam, Jammu & Kashmir, Manipur, Meghalaya, Mizoram, Nagaland, Sikkim, Tripura, Himachal Pradesh, and Uttarakhand, wherein the said limit is 20 lakhs and 10 lakhs for suppliers of goods and service providers, respectively.

There is also a composition scheme providing a concessional rate of GST on goods for businesses having turnover not exceeding INR 1.5 crores (INR 75 lakh for special category states) and services providers having turnover not exceeding INR 50 lakh in a financial year on the satisfaction of specific conditions.

Talk to our regional GST experts

Advantages of GST Calculator

Seamless

GST calculator simplifies the GST calculations such that it eliminates the manual effort, thereby producing error-free calculations

Flexible

Users can play around with the GST calculator tool with multiple combinations of GST rates, types, or methods for any given value of the transaction

One-stop solution

Pre-tax, GST tax breakups, and post-tax values can be calculated in one shot and viewed at a glance

Why is Gofrugal the Best GST Software?

Gofrugal's GST software helps you to operate your business efficiently with minimal staff and the least skills.

- Gofrugal POS takes care of the tedious GST calculations and assures 100% accuracy in business data and reliability to run a business remotely

- E-invoices and E-way bills can be generated in real-time from the POS sale invoices automatically

- Integrated accounting ensures automatic GST accounting ledger posting for both purchase and sale invoices to eliminate duplication of efforts completely

- Tax Filing Application (TFA) provides ready-to-upload files for GSTR-1, GSTR-2, GSTR-3B, and GSTR-9 filing in desired formats like JSON/Excel/CSV

- TFA also provides automatic reconciliation of Input Tax Credit (ITC) among GST books, GSTR-2A and GSTR-2B