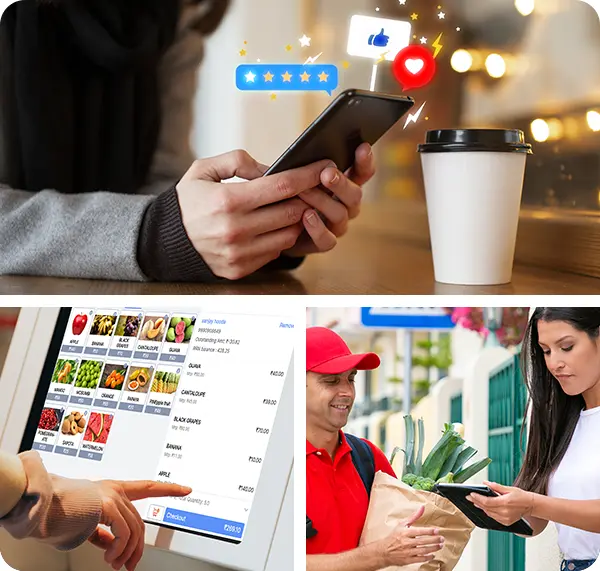

We are confident in expanding our business with Gofrugal's Order and Delivery management software. I can analogize the updates in the app as Endhiran 2.0

Mr. & Mrs. Jayakumar

Proprietors, Sarumam Pharmacy

Gofrugal has contributed significantly to our 80% growth. Our business has tremendously changed post using ServQuick and we highly recommend it for any food and beverage business

Ms. Pricillia Darshini

Manager, Jody's Restaurant

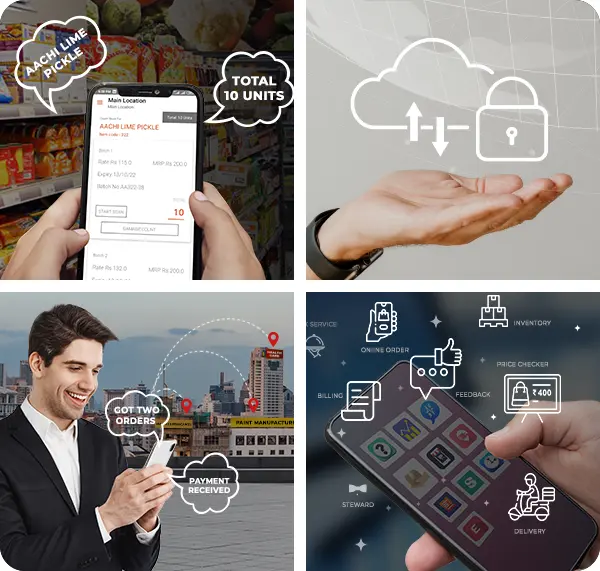

Gofrugal has really helped us grow our sales while at the same time reducing costs in raw materials as well as number of salesman

Mr. Subash

Proprietor, PonPon Sweets

With Inventory, Reports, Accounts and many more, Gofrugal is complete solution which I would recommend all Restaurateurs

Mr. Ashwin Karthick

Manager, Kites Cafe

Gofrugal has helped us offer the best and fastest service to our customers. Though we are the largest Toy store with more than 10,000 toys and books in Gujarat, we have zero worries about inventory management and auditing only because of Gofrugal ERP!

Ms. Pooja Madham

Manager, Toycra

Gofrugal is a reliable, secure, user friendly and scalable solution for Supermarket chain stores

Mr. Prem

Owner, Save Supermarket

With Gofrugal's ERP, managing my multi-store business has become easy. Using centralized data, we can control everything, including barcodes and stock transfer from the warehouse location itself

Mr. Nirav Meswani

Director, Surprise Home Linen

I love billing on Gofrugal distribution software because of its simple user interface

Mayank R.Jain

Proprietor, Sri Medi Pharma

With Gofrugal ERP, we can handle all our business operations, including billing, inventory, auditing, and e-Commerce, without hiring extra resources and any hassles!

Mr. Aashish Rana

IT Manager, House of MG