“It takes more brains and effort to file the taxes than it does to make the actual revenue,” said a harried accountant working under a sincere tax-compliant owner. Thankfully, since the advent of GST in India, tech firms and the Government are making filing taxes like Tax collected at source (TCS), Tax deducted at sources (TDS) as easy as ABC.

“Tax collected at source (TCS)” whom we assume is a newcomer, has been in India for the past six decades. It has been widened to the sale of goods above a specific limit from Oct 1st, 2020. Caution sellers! TCS tax filing can become a nightmare for you and your accountant if you chose the rough manual filing path. But do not worry because you are in the right place and at the right time. So keep calm and scroll down to become TCS tax compliant in the easiest way possible.

- What is TCS (tax) on the sale of goods?

- What goods are covered under TCS tax and on which amount TCS calculation has to be done?

- How can retailers calculate TCS tax for sale on goods in a few clicks?

- What is TCS tax calculator?

- TCS tax calculation formula

- TCS tax under GST for online sellers

- TCS tax sounds easy, can it be managed easily too?

What is TCS (tax) on the sale of goods?

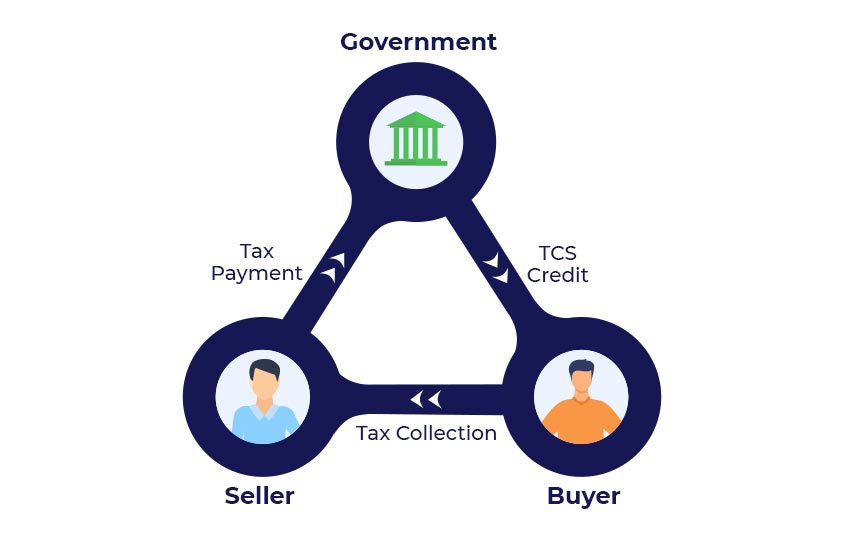

The Tax collected at source (TCS) has to be paid by the seller of goods which needs to be collected from the buyer at the time of sale. The cumulative TCS tax amount for the month should be paid to the Government on or before the 7th day of the next month. The buyer of the goods can take a credit of the tax paid, in the same financial year. If in case the seller collects an extra TCS tax amount, it can be claimed by the buyer.

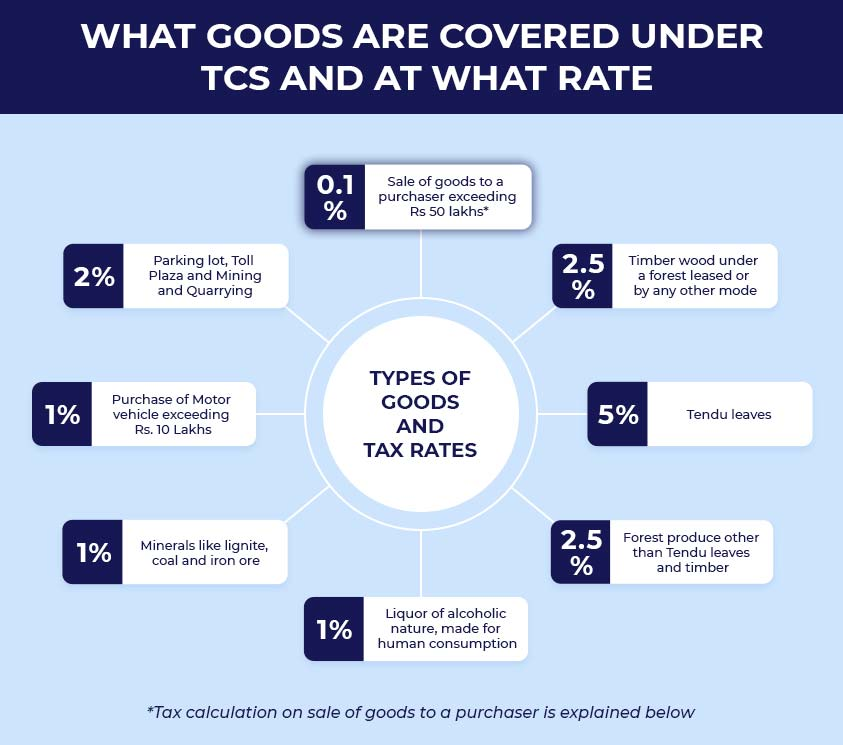

What goods are covered under TCS tax and on which amount TCS calculation has to be done?

Like you saw above, the TCS tax was launched 6 decades back. However, from Oct 1st 2020, it has to be collected on the sale of goods (electronics, auto parts, hardware, apparel, F&V, etc…) to a purchaser exceeding ₹50 Lakhs at the rate of 0.1% as per section 206C(H1).

Surprise! TCS tax calculation will not be done for the transactions under section 206C(H1) which involve TDS (Tax deducted at source).

How can retailers calculate TCS tax for sale on goods in a few clicks?

Assume, Ram enterprise has made a turnover of more than ₹10 crores in the financial year 2020-2021, then they are supposed to collect TCS tax on the sale of goods for the financial year 2021-2022.

Will Ram Enterprise collect TCS from every customer? No!

They will collect the TCS amount from a customer, say Laxman stores, only if Ram enterprise made sales above ₹50 lakhs to Laxman stores in the entire financial year 2020-2021. Now that we have understood the tax slab, let us get to work. Ram Enterprise has made a sales bill of ₹71,250 to Laxman stores and the total sales for the financial year 2021-2022 to Laxman stores has already crossed ₹50 lakhs. In this case, the TCS tax calculation will be at the rate of 0.01% (till March 31st 2021, the TCS tax rate was 0.075%).

Ram Enterprise will collect ₹71.25 and pay it to the government. Laxman stores will make a credit entry of ₹71.25 for the TCS paid.

What is TCS tax calculator?

TCS tax calculator is used to calculate the Tax Deducted at Source (TCS) from the buyer by the seller, as mandated by section 206C(H1) of the tax laws in India. This TCS collection is applicable when the buyer’s transaction value exceeds ₹50 Lakhs. Since the TCS should not be calculated for all the transactions and not for all the buyers at every instance, a TCS tax calculator helps in automating these calculations eliminating manual calculation methods, and helps in abiding by the tax rules. The TCS tax calculator, unlike other calculators, is not a separate tool and is integrated with a POS/ERP/Accounting software, thus enabling the automated TCS tax calculation during each transaction.

TCS tax calculation formula

The TCS calculation formula is relatively straightforward and has a simple calculation. However, there are specific scenarios to consider.

The TCS tax calculation formula, in general, = Value of the total bill amount * 1%(TCS rate)

Scenario 1: If a buyer purchases goods for ₹50,000 from the seller and the total transaction value of the buyer for the entire financial year is less than ₹50,00,00( including this transaction), then the seller doesn’t need to deduct TCS for this transaction. However, if the total transactions have already exceeded ₹50,00,000, the seller must deduct 1% of ₹50,000, which is ₹500, for this transaction.

Scenario 2: Let’s assume the total sales to the buyer in the current financial year amount to ₹49,50,000. Now when a new transaction of ₹71,250 is made for the same buyer, then TCS = (71,250 – (50,00,000-49,50,000)) * 0.00075 = 21,250 * 0.00075 = ₹15.94. As the TCS tax must be calculated only to the value above ₹50,00,000

Note: The TCS tax calculation comes into effect only when the overall turnover of the seller is more than 10 crores.

TCS tax under GST for online sellers

Retailers who sell on e-commerce platforms like Amazon, Flipkart can stay carefree about TCS tax as these e-commerce guys will take care of it for you, although TCS will be deducted from your revenue. Let’s see how Kiran Electronics handles TCS calculation in GST invoice.

Kiran Electronics is a GST-registered retailer that sells Samsung mobile phones on Flipkart. Now, he receives an order for ₹50,000 inclusive of tax and commission. Assume, Flipkart charges Kiran a commission of ₹400 for the sale. A deduction of 1% tax (TCS) on the amount will be made, including the money paid as commission ₹400 and GST ₹5,357.14 (as the GST rate on mobile phones is 12%). Thus, Flipkart would be deducting tax of ₹500 which is 1% of the total sales invoice value.

TCS tax sounds easy, can it be managed easily too?

Whether you are a retailer or a supplier, you will have to pass a journal entry for recording TCS on the sale of goods in your books. Let us consider you make 100s of sales bills in a month for which TCS tax needs to be collected.

1) Will you calculate the TCS amount for each and every bill using a calculator?

2) Will you even know whether TCS should be calculated for Laxman enterprise or not?

3) Will you pass 100’s of Journal entries for the TCS collection? Even if you miss one, you will end up becoming a non-TCS compliant business.

If you have scrolled down this far, I would like you to read the title once again.

Yes, this time you got to keep calm and let the tech take care. The TCS tax calculation process can be automated to an extent where all you got to do is only make a TCS payment. Tech has the ability to calculate Tax collected at source for the respective party, pass a journal entry and showcase the cumulative TCS amount to be paid at the end of one month. It is time for you to step out of accounting processes and get yourselves busy making business decisions.

If you own a POS/ an ERP/ an accounting software, then either dive deep into your software to check out the feature.

Need help? Don’t worry, try downloading a trial of our solution and replicate the above given scenario using this help article on our community page and learn how Gofrugal eased the TCS tax calculation process.

For more information on TCS tax rules and regulations, check out the links below.